Form 1099-MISC and Form 1099-NEC: What to Know and When to Send

Changes to Non-Employee Compensation and Due Dates for 2020

More businesses are relying on the help of independent contractors to complete projects, and while that’s not the only reason to file a Form 1099, it is one of the most common. Regardless of whether you had payments to contractors in 2020 or made other payments besides non-employment income, the time is drawing near to prepare and file Form 1099.

As the end of 2020 quickly approaches, now is a good time to examine books for any vendors who require 1099 forms to be sent. Changes to the 1099 form, including a new reporting method for non-employee compensation and revised filing due dates, should also be reviewed.

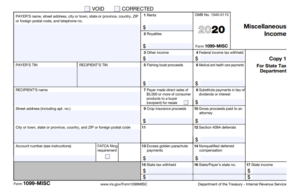

There are multiple 1099 forms, but the one that gets the most attention, and questions, is Form 1099-MISC. The new Form 1099-MISC looks like this:

Notice how the familiar Box 7, which used to be used for reporting non-employee compensation, has been replaced with something else. This is one of the bigger changes for this tax year. Other boxes have been moved around, too.

1099-MISC at a Glance

The new form is used to report payments for:

- Rents (box 1)

- Prizes and awards (box 3)

- Other income payments (box 3)

- Generally, the cash paid from a notional principal contract to an individual, partnership, or estate (box 3)

- Any fishing boat proceeds (box 5)

- Medical and health care payments; also includes payments to veterinarians (box 6)

- Crop insurance proceeds (box 9)

- Payments to an attorney (box 10)

- Section 409A deferrals (box 12)

- Nonqualified deferred compensation (box 14)

Form 1099 Q&A

We’ve received several questions from clients regarding the new 1099 form, as well as some common areas of misunderstanding. Becoming more familiar with 1099 reporting prior to year-end can make the process of organizing and submitting payment records to your CPA easier and less time-consuming.

Q: What are the threshold amounts for filing Form 1099-MISC?

A: Most business owners are familiar with the standard $600 threshold requirement to file Form 1099-MISC. What many may not be aware of is that there are other amounts and types of payments that must be recorded, too. A low $10 threshold applies for royalties paid (box 2) and at least $10 of broker payments in lieu of dividends or interest (box 8). Additionally, a threshold of at least $5,000 applies to direct sales payments (box 7).

Q: I work with independent contractors and am used to reporting their payments on Box 7 of the 1099-MISC. What’s changed this year?

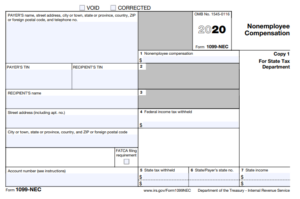

A: New in 2020, a separate form must be used to report non-employee compensation. Form 1099-NEC totally replaces Box 7 of Form 1099-MISC. The two most common examples of non-employee compensation are contract labor and payment for repair and maintenance services. There are other, less common types of acceptable NEC, such as:

- Cash payments for fish or aquatic life

- Payments to an attorney or legal provider

- Anyone who has had federal income tax withheld from your organization under the backup withholding rules

Total non-employee compensation will be reported in box 1 and any federal tax withholding in box 4. The only other boxes in the new Form 1099-NEC are state tax withheld, payer state ID, and state income, which are reported on boxes 5, 6, and 7, respectively.

Total non-employee compensation will be reported in box 1 and any federal tax withholding in box 4. The only other boxes in the new Form 1099-NEC are state tax withheld, payer state ID, and state income, which are reported on boxes 5, 6, and 7, respectively.

The new Form 1099-NEC is included here for reference.

Q: When do I need to process 1099 forms?

A: Form 1099-NEC is due on February 1, 2021 to both the IRS and recipients. Form 1099-MISC is due by March 31, 2021.

Q: Are there any exemptions?

A: Yes. Personal payments do not need to be reported on Form 1099-MISC or 1099-NEC. Payments to a corporation are also exempt.

Q: What if I didn’t keep good records of vendor payments throughout the year?

A: Although it is preferred to keep a thorough record of all payments to vendors throughout the year, even ones that fall below the $600 threshold, if that’s not the case then take the time before year-end to review and collect payment data. The IRS has started cracking down on information returns like the Form 1099.

It’s important to stay up to date because late filing penalties can get steep. A late form within 30 days will be subject to a fee of $50 per form. Late forms processed between 31 days late through August 1, 2021 will be subject to $110 per form, and anything not filed after August 1, 2021 will incur fees of $270 per form. Clearly, it’s better to take the time now to organize payment records and vendor accounts.

Q: What if I need to make a correction to a prior year 1099-MISC for a vendor payment?

A: According to the IRS, amendments to previous years – where non-employee compensation was still reported in box 7 of 1099-MISC – will still be made using the old Form 1099-MISC.

A good practice is to maintain an updated W9 form for each vendor. Another tip is to update your accounting software so it can start flagging NEC vendors starting in January 2021. You can do this by inserting a “Display Name” flag like ‘Contractor’s Name – NEC’ or ‘Rent Proceeds – MISC’ so that it’s easier to segment vendor types. Automated payroll and outsourced bookkeeping are solutions to maintaining an organized 1099 reporting function without the hassle of spending time on it yourself.

Clients of Adams Brown can expect a call or email toward the end of the year to check in on the status of any 1099 forms and offer assistance. In the meantime, if there are questions please reach out to your Adams Brown advisor anytime.