Is Social Security Going to Run Out in your Lifetime?

In early May, the Social Security Board of Trustees announced the trust funds had revenue to pay full benefits until 2035. Social Security has had a pretty good year. This projection is a year later than the one offered in 2023 and can be chalked up to more people working and, as a result, more people making the Social Security contributions you see in every paycheck.

If the Social Security trust fund coffers were to disappear completely, it would imply that no action would be taken to correct the matter between now and 2035. It seems more likely that political pressure would be placed on Washington to fix the problem before it got to that point.

If the trust fund were to run out, it doesn’t mean that Social Security payments would come to a screeching halt. The program would still be taking money out of paychecks and using that money to pay those collecting payments. It’s uncertain what might happen to payments, but Social Security has suggested they will continue.

A 2023 survey by the Nationwide Retirement Institute discovered that three out of four adults aged 50 and older believe that Social Security will run out in their lifetime. This belief may contribute to other decisions they make that affect their Social Security payments, namely that they don’t wait until they can claim all of their benefits. According to the most recent numbers, the most popular age to begin collecting benefits is 62; in 2022, 29 percent of new beneficiaries started collecting as early as possible, while 62% claimed before the full retirement age. Not waiting to full retirement age can cause up to a 30 percent cut in benefits. Also, waiting a full year past full retirement, up to age 70, can lead to an 8 percent increase in benefits. That’s per year.

While not everyone can wait that long to start taking benefits, sometimes for very good reasons, the fact that so few do so could be due to a misunderstanding. Even so, only 16% wait to full retirement age, and only 10 percent wait until age 70 and take advantage of those larger benefits.

Social Security still provides many Americans the lion’s share of retirement income. A majority of workers (88%) anticipate relying on Social Security for retirement income. Social Security should remain important to retirees’ lives for the foreseeable future.

Source: CNBC.com, May 19, 2024

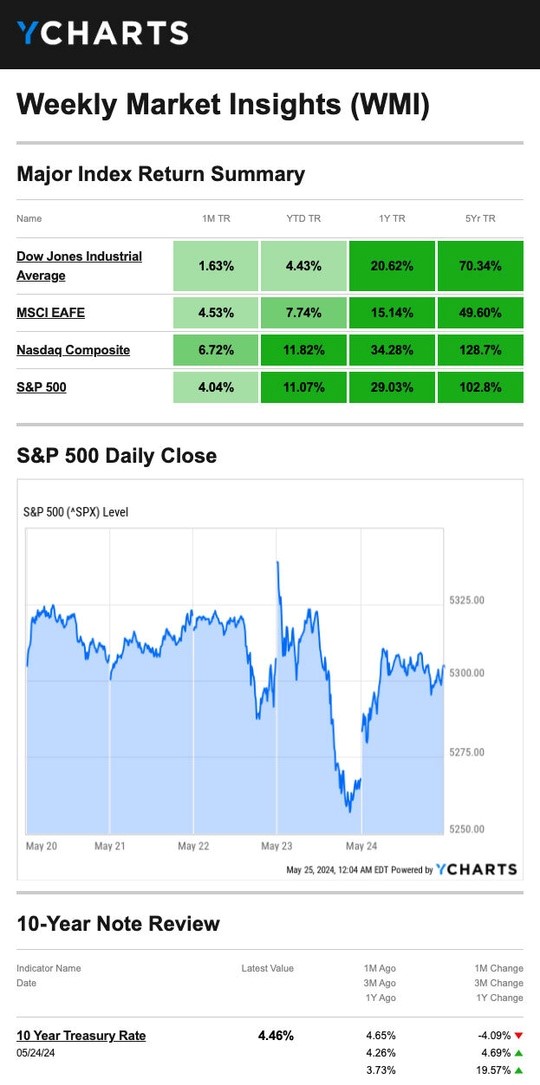

Market Insights

Stocks began trading in a narrow band last week. Still, mega-cap tech names rallied in anticipation of the Q1 corporate report from a key company that makes semiconductors for artificial intelligence (AI). The enthusiasm lifted the Nasdaq to fresh records.

Federal Reserve news mid-week unsettled investors, who reacted to Federal Open Market Committee meeting notes that stated some Fed officials worried over the lack of progress on inflation. Technology was the sole winning group for the whole week, with all other Standard & Poor’s 500 industry sectors ending in the red.

“Sell in May and go away”

Or so goes the Wall Street adage. But so far this year, that “old saw” is being tested. In fact, “Buy in May and go away” could be a better approach in 2024!

Why has May started so well? It’s all about the Fed and its outlook for interest rates.

“I think it’s unlikely that the next policy (interest) rate move will be a hike,” Fed Chair Powell said after the Fed’s two-day meeting in early May. He said deciding what’s next for rates with stubborn inflation is no simple task, but raising short-term rates does not appear to be part of the solution.

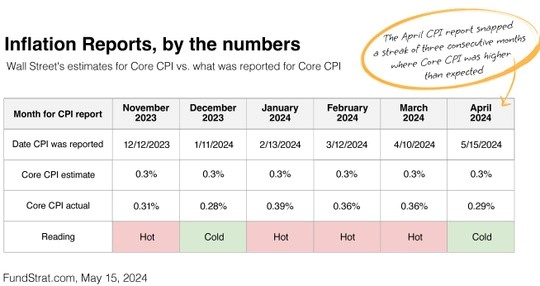

Stubborn inflation surprised the Fed when April’s Consumer Price Index was lower than expected in mid-May. The news gave a boost to the financial market’s expectations that the Fed may adjust interest rates as early as September.

So what does it all mean?

First, Wall Street maxims may have some insights, but they are unreliable when creating an investment strategy. Sell in May suggests that the stock market underperforms during the six months between May and October. Doesn’t six months seem like a long time to be out of the stock market?

Second, the April inflation report was encouraging, but the Fed will likely need more data before considering any changes to short-term interest rates. (So don’t start any refinancing paperwork yet!)

And third, if you’re holding your breath waiting for the next Fed meeting or inflation report, you may be watching financial news too closely. Sooner or later, the Fed will have enough evidence to determine what’s next for interest rates. The economy moves in cycles, so it’s only a matter of time before the Fed announces a change.

Source: WSJ.com, May 3, 2024