When is the Final Return Due?

Don’t Forget to File Taxes Upon One’s Death

The passing of a loved one is a difficult situation. As you are mourning your loved one, the furthest thing from your mind is taxes. That’s probably why filing a final tax return for the deceased is frequently overlooked.

An individual is responsible for filing a tax return for the tax period running January 1 through the date of death, if they meet the income and other filing requirements to file a return. If the requirements to file a return are not required, then a final return is not required.

For example, if your loved one passes away on July 15, then a personal representative will need to file a tax return on behalf of the deceased person for the time period January 1 through July 15 if the filing requirements are met.

What happens if you don’t file your loved one’s tax return?

If you’re the executor of the will, you may be held personally liable by the IRS for the missing funds. As with all tax legislation, it can be complicated. It’s best to file the return.

How do I file a tax return for a deceased loved one, if required?

You’ll follow the same process using a U.S. Individual Income Tax Return form or any other simplified form applicable to the taxpayer. Your loved one’s date of death will be noted on the front page of the return to notify the IRS of the deceased taxpayer.

The return is then signed by the personal representative, which might be you. If no personal representative has been appointed and if there is no surviving spouse, the person in charge of the decedent’s property must file and sign the return as “personal representative.”

When is the tax return due?

The completed tax return is due at the same time as most other individual tax returns – either April 15 or October 15 if you file for an extension. From the example above, the tax return for the January 1 through July 15 time period would be due the following April 15 (or October 15 if an extension is filed).

Can the tax return still be e-filed?

Probably not. The Social Security Administration deactivates Social Security numbers within 30 to 60 days of passing. This means you’ll most likely need to paper file the tax return.

What if a refund is expected?

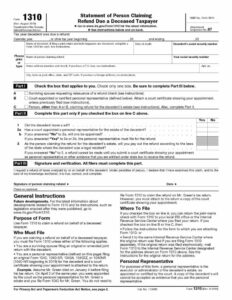

If you are claiming a refund on the deceased taxpayer’s filed return, then you will need to fill out and attach a Statement of Person Claiming Refund Due a Deceased Taxpayer form with the return in order to claim the refund.

Dealing with the loss of a loved one is never easy. Filing a tax return is also no easy task, especially when you’re filing on behalf of someone else. You don’t have to do it alone. Your Adams Brown advisor can help!