Make Sure You’re Withholding Enough Income Tax in 2020

IRS Offers More Guidance for 2020 W-4

If you own or manage a business that has employees, you have to withhold taxes from their paycheck. This past year, many Americans were upset that their tax refunds were not as big as in the past. That’s because they got more in every paycheck. Others owed when they never owed before. Those who wanted to change their W-4 didn’t know how to fill it out or consider all the changes from recent tax reform. Today, the IRS has a better solution.

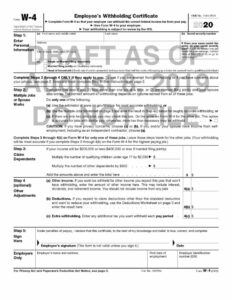

The IRS recently held a webinar to offer guidance on the redesigned W-4 withholding form for 2020. Form W-4 is designed to make sure you, the employer, are withholding the correct federal income tax amount from your employees’ paychecks.

When the new W-4 was originally proposed, there was a lot of resistance from the payroll processing community due to the high degree of uncertainty in the application process. After much collaboration, both sides have come to a substantial agreement and are trying to make the transition to the new form as smooth as possible.

Here’s what you need to know to make sure you’re withholding the proper amount from your employees’ paychecks:

Why redesign Form W-4 in the first place?

The IRS had you in mind! The redesign is intended to simplify the form for you and your employees. The goal is to reduce complexity and increase accuracy when it comes to calculating income tax withholdings.

How is the 2020 W-4 different from previous years?

- The form now has five steps

- Steps 1 & 2 have the same information as the 2019 W-4 (filing status/multiple jobs or spouse works)

- Step 3 allows you to calculate child and dependent credits, as well as add any other expected credits to reduce withholding

- Step 4(a) allows you to indicate the amount of tax you want to be withheld for other income (interest/dividends/retirement)

- Step 4(b) allows you to reduce withholding for deductions you expect other than the standard deduction, as well as any adjustments to income

- Step 4(c) allows you to enter any additional tax you want to be withheld

Should I have employees complete a new form?

For employees you hired before 2020, there’s no need to have them fill out the 2020 W-4. You or your payroll provider will continue to calculate your withholding based on the W-4 that was filled out most recently. However, if you have employees who are unhappy with the amount withheld from their paychecks each year, have them complete a new form. When in doubt, contact your Adams Brown advisor with questions.

Anyone you hire in 2020 needs to use the new form.

Do employees have to disclose non-job income?

For members of your team that have income from earnings on investments, retirement income, or income from sources that aren’t your business, they do not have to disclose said income on the new W-4 form. However, step 4 of the form allows taxpayers to withhold tax for any additional income they expect to have during the year. Employees can also make estimated tax payments using Form 1040-ES to avoid withholding too little altogether.

Will I need two payroll software systems to account for both old and new forms?

You’ll still use the same set of withholding tables for both forms, which allows you to apply them separately if you prefer two systems, or singularly if you prefer one system. A final version of Publication 15-T, which contains Federal Income Tax Withholding Methods for both the old and new forms will be released in December. Stay tuned!

With a goal to simplify the W-4 while increasing the accuracy in terms of current tax law, this revision should help your employees better understand and control the taxes they may pay now and at filing time. Keeping up-to-date with the constant churn of changes from the IRS can be a full-time chore. Your Adams Brown advisor is here to help and answer questions!

With a goal to simplify the W-4 while increasing the accuracy in terms of current tax law, this revision should help your employees better understand and control the taxes they may pay now and at filing time. Keeping up-to-date with the constant churn of changes from the IRS can be a full-time chore. Your Adams Brown advisor is here to help and answer questions!