How AI & Tariffs are Changing the Way Companies are Valued

What Is your Business Really Worth?

Key Takeaways:

- AI and tariffs are changing how businesses are valued by directly affecting cash flow, risk and growth.

- Regular business valuations help owners uncover operational improvements, plan for transitions and track growth over time.

- Knowing your company’s value gives you a clear starting point for making smarter, more strategic decisions.

As a business owner, you’ve likely wondered what your company is truly worth. Whether you plan to sell, transition to a key employee or grow your operations, a business valuation provides the clarity needed to make informed decisions.

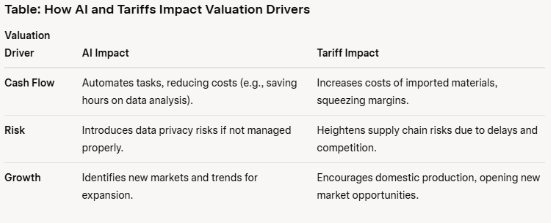

Two factors—artificial intelligence (AI) and tariffs—are reshaping how businesses are valued. While the effects of AI and tariffs vary by industry, they influence the core drivers of valuation—cash flow, risk and growth—in significant ways.

Drawing from a recent webinar by our valuation advisors, Holly Rook and Tiffani Horth, this article explores how these impact your company’s value and offers practical steps to navigate them effectively.

Why Valuations Matter for You

Picture this: your business is like a hidden gem. You’ve poured years of sweat, tears and maybe a few too many cups of coffee into it, but do you know its actual value? A valuation isn’t just a number—it’s a tool to understand your investment. Unlike stocks on the NASDAQ, your privately held business doesn’t have a ticker showing its worth every day. A valuation gives you that clarity, helping you compare it to other investments in your portfolio, like real estate or stocks.

Valuations are forward-looking. They’re not just about what your business is worth today, but where it’s headed. Think of it as a roadmap for making strategic decisions—whether you’re eyeing a sale, planning for growth or figuring out how to maximize returns.

3 Key Drivers to Boost your Company’s Value

A business valuation assesses your company’s worth by analyzing three key drivers:

- Cash Flow: The profitability of your business, which you can directly influence through cost management and operational efficiency.

- Risk: Factors that could reduce value, such as reliance on a single client or market volatility increase the company’s risk profile. Lowering risk increases your valuation.

- Growth: Your company’s potential to expand, whether through new markets, products or innovations, which boosts value.

Both internal strategies and external forces, like AI and tariffs, shape these drivers. Understanding their impact can help you make strategic decisions to enhance your company’s worth.

How AI Affects Business Valuation

AI is no longer just for tech giants—it’s a tool businesses of all sizes can use to improve efficiency, drive growth and manage risks. Here’s how AI influences your business’s value:

- Enhancing Cash Flow Through Efficiency

AI can automate repetitive tasks, reducing costs and boosting profitability. For example, dental practices leverage AI to schedule and analyze X-rays, improve service quality, and cut operational costs. By streamlining processes, AI directly enhances cash flow, making it a critical valuation driver.

- Driving Growth Through Insights

AI’s ability to analyze vast datasets helps identify trends, customer preferences and underserved markets. Holly and Tiffani noted in the webinar that their team uses AI for industry research to uncover new business opportunities. For instance, AI can reveal market gaps or predict demand, enabling you to expand strategically and increase your company’s growth potential.

- Managing AI-Related Risks

While AI offers significant benefits, it also introduces risks around data privacy and security. The presenters emphasized using strict guardrails to avoid inputting sensitive data into public AI tools like ChatGPT. Mishandling data could lead to legal or reputational issues, increasing risk and potentially lowering your valuation. Implementing AI with robust security measures is essential to maintain value.

The Tariff Factor: Risk and Opportunity

Tariffs have become a major issue for manufacturers, distributors, and construction companies. They can strain supply chains and shrink profit margins—but they also present opportunities for those who can adapt.

- Cash Flow Pressure

Tariffs may raise the cost of imported materials like steel or electronics. That can squeeze margins, delay projects and make pricing less competitive. If your business depends on imports, this directly hits your cash flow—lowering value.

- Supply Chain Risk

Tariffs can cause ripple effects across global supply chains. Sudden regulatory changes or shipping delays create uncertainty, which increases risk and drives valuations down.

- Domestic Growth Opportunity

The upside? Tariffs are encouraging reshoring. Businesses that pivot to domestic suppliers or manufacturing may enjoy more stable operations and access to new markets. Holly and Tiffani noted clients who’ve gained competitive advantage by embracing domestic production.

Valuation Case Study: Aero Mach Labs

Aero-Mach Labs, a family-owned aerospace manufacturer based in Wichita, Kansas, specializes in the repair and manufacturing of legacy airplane parts, particularly analog dials for aircraft dashboards. Despite operating in a market that is gradually shrinking due to the industry’s shift towards digital dashboards, the company has been increasing its market share by excelling in its niche.

To navigate the challenges of a volatile industry and plan for the future, owners Jeff and Gina Carnley engaged in recurring business valuations with Adams Brown. These valuations provided strategic insights that prompted the owners to think critically about their business operations and identify areas for improvement.

One key area identified was inventory management. The company recognized that it had excess and obsolete inventory, which was impacting its financial performance. By taking action to write off obsolete inventory, Aero-Mach Labs was able to improve its financial metrics significantly. Within six months of their initial valuation, the company saw an increase in its value, demonstrating the effectiveness of using valuation data to drive operational changes.

In addition to addressing inefficiencies, the valuations highlighted opportunities for growth through diversification. Aero-Mach Labs pursued strategic acquisitions of complementary businesses, allowing them to expand their manufacturing capabilities and reduce reliance on their core market. This diversification not only spread risk but also positioned the company to capture additional market share as competitors retired.

The impact of these strategic initiatives was substantial. Aero-Mach Labs achieved a 12% annual return on investment, a notable accomplishment given the economic volatility during the period. The recurring valuations enabled the company to track its progress, compare performance over time, and make data-driven decisions that transformed potential weaknesses into strengths.

This case study illustrates how business valuations can empower owners to understand their company’s worth, identify actionable insights and implement strategies that enhance value, even in challenging markets. The principles applied by Aero-Mach Labs are applicable to businesses facing various external pressures, including those related to technological advancements like AI or economic factors such as tariffs.

When to Get a Valuation

Regular valuations, ideally at year-end, align with your financial reviews and provide a benchmark for your company’s performance. They help you track progress, compare returns to market indices and adjust strategies in response to factors like AI advancements or tariff policies.

Ensuring Transferable Value

If you’re planning to sell or transition your business, ensuring transferable value is important. Goodwill, which can account for 80% of a service-based company’s value, must pass to the new owner. Build enterprise goodwill by documenting processes and involving key employees in client relationships, reducing dependence on you. For multi-owner businesses, a buy-sell agreement is essential to outline valuation and transfer processes during events like disputes or death.

Questions?

AI and tariffs aren’t just buzzwords—they’re real forces shaping your company’s future. Whether you embrace new tech, shift supply chains or prepare for ownership transition, knowing your company’s value is the first step. For more guidance, contact a business valuation expert at Adams Brown.