Diversification & Specialization Enhance Architecture Firm Value

How much can you sell an architecture firm for?

Architecture firms are diversifying these days, adding such services as interior design and land surveying, as well as new specialties. Besides increasing their service offerings and broadening relationships with clients, these services are also helping enhance the market value of many architecture firms.

While some architecture firms are combining with engineering firms to become one-stop shops, many are also specializing in emerging areas such as facilities for elder care and congregant retirement living, and green architecture, which focuses on environmentally friendly design and building techniques.

The impact of these offerings on a firm’s value can be significant, in large part because they mitigate risk by diversifying a firm’s sources of revenue or, conversely, becoming known as a sought-after resource in their area of specialization.

How is an Architecture Firm Valued?

As with other professional services companies, valuations of architecture firms are primarily reached by utilizing:

- The income approach, examining the company’s historical income going back three to five years. If the company is in a growth mode, a discounted cash flow method may be applied. For a company with stable earnings, capitalization of the cash flow method may be applied.

- The market approach may be combined with the income approach to determine the prices of comparable transactions in the same geographic region over the past year. Thankfully, finding comparable transactions in this industry is somewhat simple because of the volume of deals in this space. The industry is going through a consolidation phase.

Service-oriented companies typically have a higher level of goodwill and both the income and market approaches take that into account in a valuation.

With architecture firms, there is a high correlation to value for certain multiples because they are widely used in this industry, including:

- Price to sales

- Price to EBITDA (Earnings Before Income Taxes, Depreciation and Amortization)

- Price to Sellers’ Discretionary Earnings (EBITDA + One Owner’s Salary)

Additionally, with companies that are growing substantially, a valuation professional will look at the growth trajectory – historical and projected – to determine how the anticipated rate of growth may impact the multiple.

Factors Unique to Architecture Firms

Valuing architecture firms requires understanding how the unique qualities of these companies impact their value and which valuation approaches will yield the most realistic range of value.

Workforce

One of the unique qualities of architecture firms is the key role that a stable professional workforce plays in valuation. Architecture is an unusual field in that it is populated by professionals who possess both artistic vision and technical knowledge, making the profession a unique blend of science and art. Attracting young professionals with these skills and keeping them for the long term requires a commitment to developing them and offering them retention incentives early in their careers.

For that reason, many architecture firms offer employee stock option plans – ESOPS – which enable young professionals to buy shares in the company at an early career stage and build their shares steadily over the years. The opportunity to build ownership through an ESOP helps firms retain talented young professionals and groom them for leadership roles.

Diversification

Diversification of service offerings and industry specialties are both key factors in architecture firm valuations because they reduce concentration that can increase risk. The more services the firm provides in-house, the more attractive it may be to a potential buyer.

Likewise, diversification reduces workforce risk, as well. By retaining young professionals with well-designed compensation and benefit packages, training and leadership development, firms maintain diversification of age and experience that benefits a company that relies on artistic talents and an understanding of changing tastes.

Additionally, diversification of client groups gives an architecture firm breadth in the marketplace that can guard against concentration in any one industry or group.

Specialization

Specializing in two to three industries can also drive value for your firm. Being known as the best regional firm for medical or long-term care facilities can make your practice more valuable in the eyes of a strategic buyer that wants to capitalize on the synergies of adding name recognition and internal know how.

Internal and External Buyers

Understanding who the likely buyer may be for an architecture firm is a key factor in the valuation process.

Like many professional services companies, architecture firms rely heavily on longstanding relationships and their reputations for continued success in the marketplace and company partners want to maintain that stability.

Strong buy-sell agreements or shareholder agreements create an internal marketplace that may ensure that ownership remains within the company. Moreover, a partner who is preparing to retire and who owns a 20% to 30% stake in the business may offer those shares to another owner whom they’ve previously identified, or to multiple owners.

An internal transaction that is influenced by a strong buy-sell agreement can also ensure that the remaining owners get a fair price in the transaction. The standard of value used for an internal transaction is Fair Market Value (FMV). An external buyer will consider the investment value, so the firm could command a premium over FMV. However, the ownership group would have to consider what it is giving up in return for that higher price.

The Outlook from Here

As many partners have neared retirement, the number of transactions in architecture firms has steadily increased over the past five years and is showing no signs of letting up.

Moreover, the mix of buyers is trending more to internal buyers, owing in part to strong buy-sell and shareholder agreements. Many firms are extending partnership to their professionals at a younger age and are starting succession discussions when partners are around 50 years old. These are excellent practices.

People are your greatest asset, so the best moves that leaders of architecture firms could make include:

- Cultivate a good culture.

- Be transparent with your current and prospective owners about the firm’s valuation.

- Put strong buy-sell agreements in place.

- Make sure your buy-sell agreements are transparent and consistent.

- Get a second opinion – work with an accredited valuation professional.

- Review and update all buy-sell agreements every three to five years and consider having your buy-sell agreement reviewed by a third party from time to time.

Deal Volume and Pricing

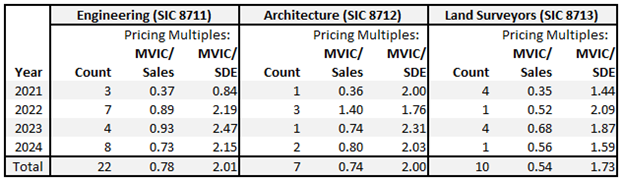

Engineering, architecture and survey company valuations have remained strong in recent years with transaction volume increasing in the engineering sector. Median multiples have for firms in the engineering crested in 2023 (using the price to sales and price to SDE multiples as a metric); however, it is important to consider the qualitative aspects of each firm. Deal volume has not been as strong in the architecture and land surveying space. However, we noted that deals for engineering firms also offered architectural services as its secondary offering and those firms were grouped with Engineering firms.

MVIC (Market Value of Invested Capital) = Market Value of Debt + Market Value of Equity

Source: DealStats, a database from Business Valuation Resources. Asset transactions only, about 55% of the transactions were companies in FL. Information downloaded on 5/19/2025.

If you would like to discuss a valuation of your architecture firm, contact an Adams Brown advisor.