‘Decision Tree’ Model Helps Focus Exit Planning

Creating a Roadmap, One Logical Step at a Time

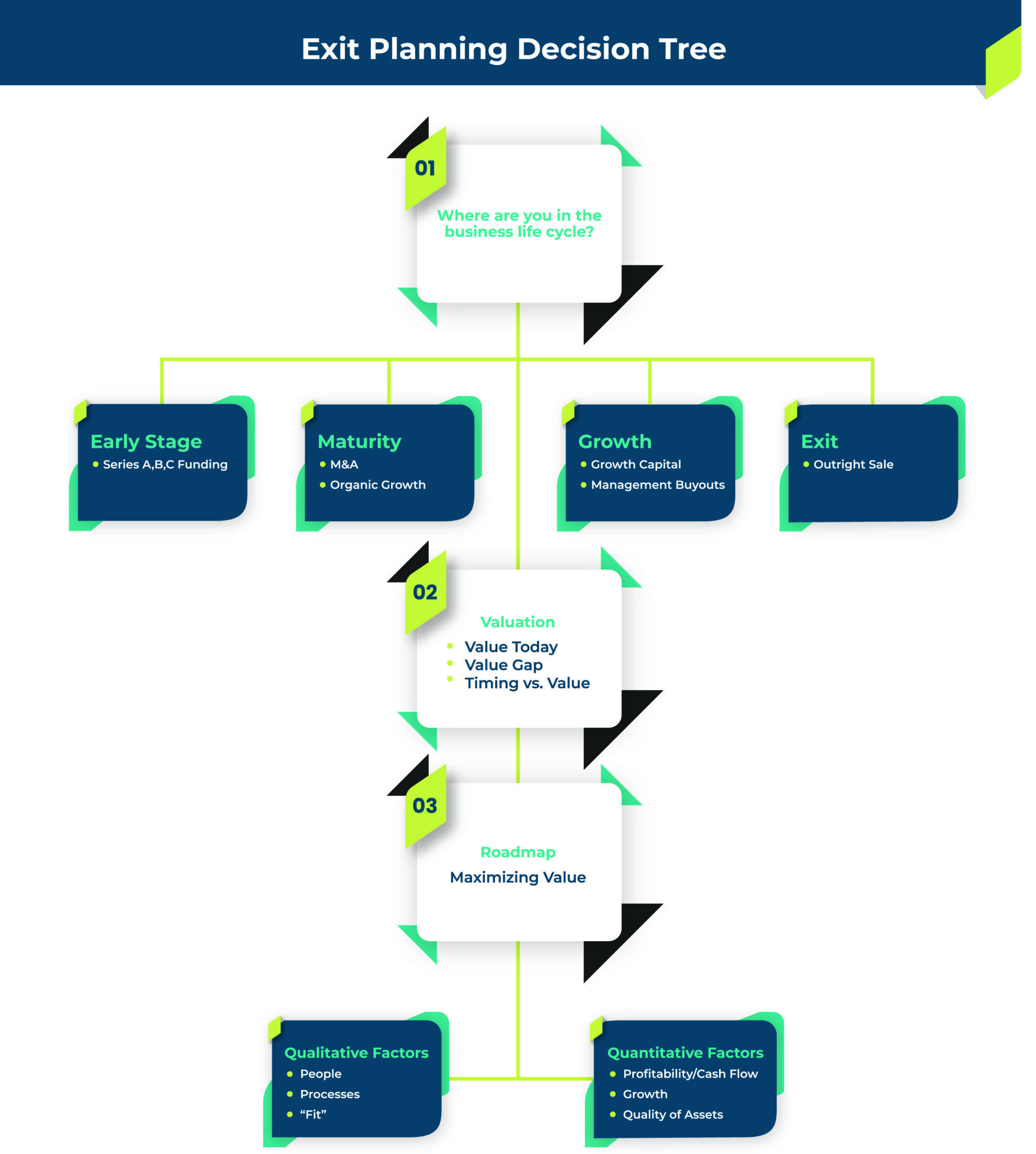

Strategic planning for a business exit is a important tool for clearing the path. A “decision tree” model of planning, combined with a realistic timeline, provides a clear roadmap to a successful business exit.

A decision tree is a helpful tool that focuses your thinking and leads you from one step in your journey to the next logical step. But building the right decision tree and following it through the process requires an accurate, realistic view of your business, your personal goals for exiting and your expectations of the post-transaction period.

A decision tree model of planning helps you understand where you are headed, whether you have the right directions, advisors and managers, and what stops you may have to make along the way to ensure you reach your desired destination.

First Step in Decision Tree

The first step in constructing a decision tree is looking at where you are in the lifecycle of your business.

- Are you at the launch stage and looking for guidance on entity selection, financial guidance and consulting that will set the stage for a successful transaction later?

- Or is your business in the growth stage, where tax optimization, strategy development and wealth management are important issues?

If your business is a mature company, it may have needs for strategy refinement, major tax incentives, tax research and regular CFO-level strategic planning. In the transition phase leading up to a transaction, business valuations, merger and acquisition consulting, exit planning and estate planning will be on the front burner. The decisions made for a mature company would not make sense for one that is at the launch stage, and vice versa.

Why Do I Want to Exit?

A critical branch on the decision tree will be the question of why you want to exit your business. Do you have an opportunity – perhaps an unsolicited offer – to cash out on your hard work and success? Are you looking forward to retirement after many years of building your business? Or do you have a desire to pursue another career or venture?

The why will dictate how you tell the story of your business, what the profile of the right buyer will be and whether your plan addresses the qualitative factors you have raised. It will answer questions about what you will do after the transaction, and particularly whether you will stay on for a two-year earnout period. The new owner may need you to stay on for a while to help transfer customer and vendor relationships.

Business owners who are committed to selling get deals done more quickly and successfully than those who are uncertain.

So all the decision tree questions up to this point are crucial to your success – particularly the personal factors related to why you are considering exiting.

If you’re an older business owner and you want to retire immediately, a buyer who wants to acquire your company and is willing and capable of running it without your involvement is your target buyer. But if you’re 45 years old and you want to remain as a minority shareholder, helping to usher the company to its next plateau, your target buyer looks very different.

Valuing the Company

Regardless of the reasons for seeking an exit, most owners need to identify the magic number that addresses many factors on the decision tree. On a personal level for the owner, the asking price must answer the question of what they need in order to maintain a standard of living and enjoy retirement. On the business side, the asking price must reflect the true value of the company in a rapidly changing marketplace. Factors to consider include:

- What kind of price can the business capture in the current marketplace?

- Are the company’s performance, ownership structure and market conditions all aligned to attract the right kind of buyer?

This is a stage of the transition when company owners most need to consult with advisors who know the marketplace and know their industry.

Next Steps

It’s time to figure out where you are on the roadmap. Either you’re at your destination, or you’re not even close.

If you’re not close, don’t worry. It happens. What’s the next branch on the decision tree? Why are you not close? Is your company lagging the industry? Have market conditions turned sour? It’s important at this stage to determine whether internal or external factors are responsible for your stall out.

If external factors such as the economy or market conditions are working against you, consider whether you can wait it out by pushing your exit to the next year.

But if the obstacles are internal, a new series of decision tree questions may arise:

- Why is your company doing 10% margins when your industry average is 18%?

- Why is your cash flow weak?

- Why is your customer attrition rate higher than a few years ago?

- Why has your company not expanded beyond a narrow customer concentration?

Market factors, industry factors and company factors all must align to tell the best story to potential buyers, and this is the phase when you are honing your story into its final form.

If you are retiring, and your key managers are planning to follow you out the door, how does that impact the value of your company as perceived by a potential buyer?

How many hats are you wearing? Are you acting as CEO, COO and general manager? If so, how much will it cost the buyer to hire professionals to fill all your roles, and how does that impact value?

If any one of these factors is an obstacle, it’s time to pause the process and make improvements, which creates another branch on the decision tree, one that leads down the path of making renovations to bring your company’s performance up to a standard that will support your asking price.

Qualitative & Quantitative Planning

Once you’ve established where you are, it’s time to get directions. For that, some qualitative and quantitative business planning is needed to help you understand what drives value for the company at its current stage of maturity.

Early-stage companies are more focused on a proven concept, getting the products and services right. Companies at this stage may be sacrificing revenues to prove they are viable, and that’s fine – for a while.

At the growth stage, it’s time to get some revenues in the door. But the focus is less on profitability and more on getting early adopters on board, or building dedication among key customer groups.

When the company reaches maturity, it’s time to put the pedal to the metal on revenues. Value drivers will focus heavily on revenues, cash flow, growth and risk. Mergers and acquisitions happen at both the growth and maturity stages of the business lifecycle and the key drivers at these stages are cash flow, growth and risk.

During the transition phase, your focus will be on understanding your value drivers and how they impact where you are in the lifecycle of the business. Are you planning on exit (selling to an outside buyer) or on succession (transferring the business to a younger generation of family owners or to key employees through an ESOP)?

The Selling Phase

You have committed to making the transition out of your company, you’ve made the necessary renovations to your business, the company’s cash flows have improved, and you have determined what the asking price range will be. Moreover, the marketplace is strong and the economy is stable or improving. All the indicators are looking good for moving forward with the sale.

It’s time to speak with a business broker, someone who puts buyers and sellers together, who can give you honest feedback about what the market is looking for and whether you have it. You can determine at this point whether working with a broker to find qualified buyers will move the process forward more quickly. Brokers come with a fee – similar to a real estate agent who will help you sell your house – and they can make your life easier as you go through the process. Selling a company typically takes about six to 12 months when the seller works with a broker, and longer if not.

Closing Period

When you’re at the point on the decision tree where a prospective buyer has made an offer, there are still decisions to be made.

- Does the buyer fit the right profile?

- If you want your company to survive and continue employing your loyal workers and serving your long-time customers, does that vision align with this buyer’s plans?

- Is the offer within a range where you believe you can negotiate a final deal that will make both sides happy?

If the buyer wants you to continue working through an earnout period, does that align with your plans? If not, this can be a good time to stress test your business by stepping back and challenging your management team to run the company without your day-to-day involvement. You may ultimately decide that what you expected to do – such as retire immediately – is not what you wanted and would not benefit the company. An earnout period may satisfy both you and the buyer.

Questions?

Using the decision tree model of strategic planning throughout your exit planning process helps to focus your thinking and your action, and leads to more confident, effective decision making.

If you would like to discuss putting together a focused strategic plan for your exit process, contact an Adams Brown advisor.

Download a copy of the Decision Tree Infographic