TaxCaddy Tips & Resources

Below you’ll find information, tips and resources that will assist you in using TaxCaddy.

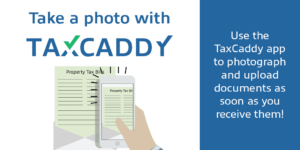

Instead of using the camera on your smartphone, be sure to use TaxCaddy’s photo-scan feature to take pictures of your documents. TaxCaddy will convert your photos to high-quality PDF images in your account.

Instead of using the camera on your smartphone, be sure to use TaxCaddy’s photo-scan feature to take pictures of your documents. TaxCaddy will convert your photos to high-quality PDF images in your account.

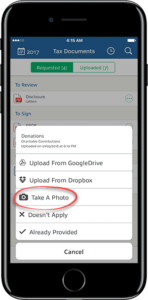

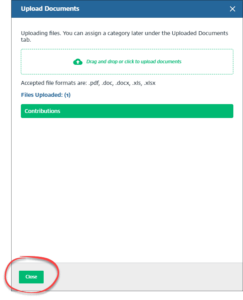

It’s best to directly upload PDF documents, especially brokerage 1099s. You can do this by dragging and dropping the PDF into your account. Here’s what it looks like in the TaxCaddy app on your smartphone.

You can drag and drop any tax documents you receive electronically directly to your TaxCaddy account. By dragging and dropping the files directly, you won’t need to print anything and the image quality will be higher.

You can drag and drop any tax documents you receive electronically directly to your TaxCaddy account. By dragging and dropping the files directly, you won’t need to print anything and the image quality will be higher.

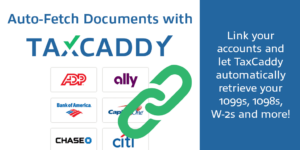

Setting up Smart Links for your government tax documents allows us to receive your tax documents as soon as they’re available. We recommend setting up Smart Links to save you time and expedite the tax filing process.

Setting up Smart Links for your government tax documents allows us to receive your tax documents as soon as they’re available. We recommend setting up Smart Links to save you time and expedite the tax filing process.

Before your tax return is delivered, invite your spouse to join your account. Activating your spouse’s access enables you both to electronically sign the e-file authorization form.

Selecting “Reply With Account” for any requested document is especially helpful for medical expenses and charitable donations and contributions. For your personal records, make sure to keep any written acknowledgement of a contribution of $250 or more from a charity. For the purpose of preparing your tax return, a summary of all contributions is all that’s needed. Each individual acknowledgement letter or receipt is not necessary.

If you have a business that needs a recap, download the appropriate file below.

- [2024] Personal Information

- [2024] Cash Contributions

- [2024] Foreign Bank and Financial Accounts

- [2024] Foreign Financial Assets

- [2024] Investment Interest Expenses

- [2024] Medical Expenses

- [2024] Mortgage Interest Expenses

- [2024] Non Cash Contributions

- [2024] Other Taxes

- [2024] Personal Property Taxes

- [2024] Real Estate Taxes

- [2024] Schedule C Organizer

- [2024] Schedule E Organizer

- [2024] Schedule F Organizer

- Submit an online request via TaxCaddy’s Help Center -OR-

- Email support@taxcaddy.com.

- Their support hours are Monday through Friday from 7 am to 5 pm PST, excluding holidays.

How to Use Tax Caddy

Filing your income tax return can be a time-consuming hassle. Your tax professional’s work is complicated, but your part should not be. Lean how to use TaxCaddy to simplify the tax filing process.