2025 Construction Tax Planning Guide

Stronger Cash Flow. Smarter Investment Decisions. Fewer Surprises.

Construction moves fast. Tax law moves faster. Between material volatility, labor pressure and tight margins, you do not have time for policies that change the math halfway through the year. The 2025 tax environment introduces new opportunities for contractors to strengthen their financial position, but only if you know how to leverage them.

This guide breaks down what matters most for contractors right now:

A New Era of Tax Opportunities Under OBBB

The One Big Beautiful Bill created one of the most favorable tax landscapes contractors have seen in years. Several provisions directly strengthen cash flow, reduce tax burden and support long-term planning.

- 100 percent bonus depreciation

- Contractors can fully expense qualifying equipment and certain property placed in service in 2025. This removes the guesswork from planning large purchases and frees up capital for payroll, materials or debt reduction.

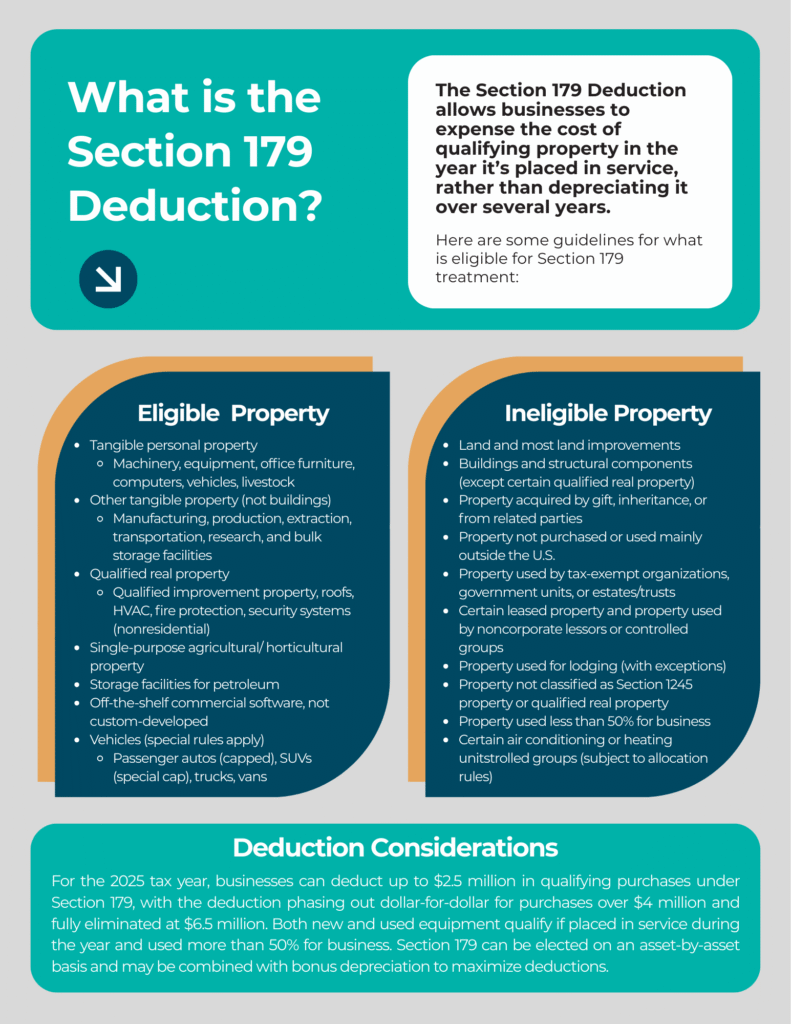

- Higher Section 179 expensing

- With a $2.5 million limit and a $4 million phase-out threshold, mid-sized contractors can expense more equipment immediately. The permanence of this change means you can build multi-year capital plans with confidence.

- Expanded accounting method flexibility

- Smaller contractors have more choice in how income is recognized. The right method can smooth earnings, reduce tax volatility and protect cash during big project cycles. Larger contractors have additional options under updated PCM standards and ASC 606 alignment.

- Pass-through tax relief

- The permanent 20 percent Qualified Business Income deduction keeps S corporations and partnerships competitive with C corporations. This helps owners preserve more personal cash while reinvesting in the business.

Taxes are one of the largest expenses in construction and one of the best opportunities to improve profitability if you plan ahead.

Download the full tax guide to learn more.

Contractors want clarity. Predictability. A partner who understands retainage, bonding, cash flow strain and the many ways tax law hits this industry differently.

The Adams Brown construction team lives in this world every day. We help owners:

- Map tax strategy to project pipeline

- Reduce estimated tax payments with smarter timing

- Evaluate S corporation versus C corporation impacts

- Protect margins during expansion

- Plan capital purchases with long-term visibility

- Build tax-efficient succession plans

The goal is simple: strengthen your business so every project supports long-term growth.

Contact an Adams Brown construction advisor to discuss further.

More on Section 179…

Author: