Stocks Dip, Then Rally

By almost any measure, 2023 was a terrific year for stock prices.

The Standard & Poor’s 500 index finished up 24%, closing out the year with a nine-week winning streak. But throughout January, the naysayers were out in force trying to talk down the stock market’s potential. Here’s a sampling of some January 2024 headlines from CNBC.

- “The ‘Santa Clause Rally’ is in trouble, and that may signal weaker stocks.”

- ” ‘Big Short’ investor Steve Eisman worries about bullishness level on Wall Street.”

- “Why it could be a ‘lose-lose’ situation for Wall Street when Fed does cut rates.”

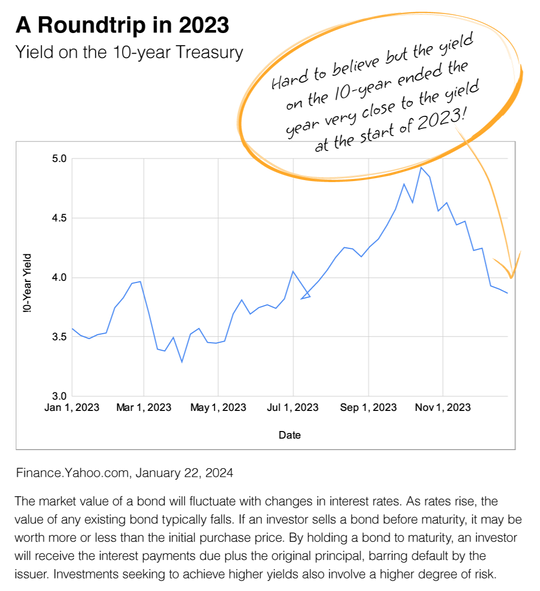

The accompanying chart helps illustrate the danger of believing headlines when financial markets appear unsettled. In October, many Wall Street pundits were saying, “Interest rates are going higher” and investors should prepare. But by the end of the year, you can see that the 2023 roundtrip in interest rates was nearly complete.

As we kick off the New Year, remember to keep your focus on a disciplined, carefully constructed portfolio approach that takes into consideration your goals, time horizon and risk tolerance. Will 2024 bring some volatility? That’s almost certain. But portfolio decisions should follow careful guidance and insight, not knee-jerk reactions to market cycles or one-day headlines.

Market Insights

Stocks finished higher last week, with big tech again leading amid lingering uncertainty over how continued economic strength would influence the Fed’s rate decision.

Stock prices dropped early in the week before rising to new highs as the week ended. The four-day trading week began with more Q4 bank earnings, which disappointed. The yield on the 10-year Treasury climbed after a Fed Governor said the central bank may not adjust rates as much as markets expect. That and a stronger-than-expected holiday retail sales report put pressure on stock prices.

Tech stocks drove the rally, with the S&P and Nasdaq recouping their 2024 losses. Stocks continued their tech-led climb with the S&P 500 rising to an all-time high—its first record close in over two years. The Nasdaq gained 1.70%, capping a solid week for the tech-heavy index.

Source: YCharts.com, Jan. 20, 2024. Weekly performance is measured from Monday, Jan. 15, to Friday, Jan. 19

Navigating the Middle

Sentiment see-sawed last week as investors tried to anticipate the Fed’s next move. The week was full of economic news that suggested continued resilience in the economy, which may add complexity to the Fed’s next decision.

December retail sales came in strong, +0.6% for the month, besting economists’ expectations of +0.4%. November and December combined to depict a robust holiday shopping season. Unemployment dipped unexpectedly for the second week of January–a sign of a resilient U.S. labor market. That labor news and hotter-than-expected housing starts pushed the yield on the 10-year Treasury to 4.14%, its highest level in more than a month.

Source: CNBC.com, Jan. 16, 2024