October Economic Update

Stubborn Inflation Tests Fed’s Resolve

Stubborn doesn’t seem like a strong enough word, but that’s how Fed officials are describing inflation. Inflation’s “stubbornness” has been on full display in recent weeks:

- First, the Producer Price Index (PPI) showed that costs remain high for producers of goods and services.

- Then in September’s more widely followed Consumer Price Index (CPI) high prices continued to persevere.

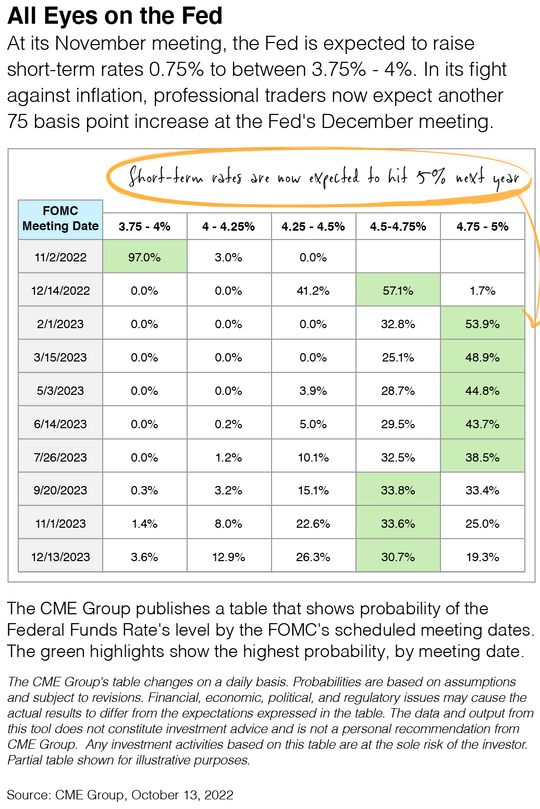

To address inflation, the Fed’s primary tool is short-term interest rates. As it pushes rates higher, the Fed aims to slow the economy by raising borrowing costs. As economic activity cools, the Fed expects to see the CPI and PPI trend lower.

In the table below, you can see what professional traders anticipate will happen with interest rates over the next year. They expect the Fed will have to raise short-term rates to nearly 5% in 2023 to lower inflation.

JOLTS Of Optimism For The Markets?

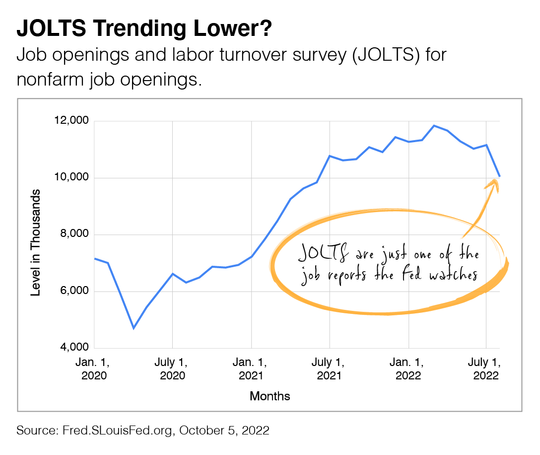

We measure the jobs market in many ways, but the Job Opening and Labor Turnover Survey or JOLTS report seems to be of particular interest to Fed Chair Jerome Powell.

The JOLTS report tells the Fed how many job openings there are each month. It also shows how many people were hired, quit, or were laid off.

Given the above, there’s no doubt the Fed welcomed the news illustrated in the chart below.

The Fed is looking for three key things in its fight to stabilize the economy. A slowed Gross Domestic Product (GDP), inflation as measured by the Consumer Price Index to fall, and the labor market to soften. Now, GDP has already slowed, but as we all know, inflation has yet to be tamed, and the labor market is mixed at best.

This means the financial markets are in a “bad news is good news” phase. Put another way, the bad news of fewer job openings is good news to Fed officials. We understand this “bad is good” phase can be confusing, to say the least, so please reach out if you have any questions.

The CEO’s Unofficial Q2 Buzzword

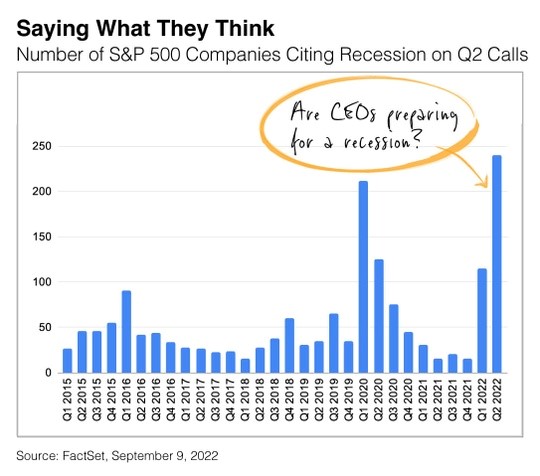

You may have heard the expression, “You can talk yourself into just about anything.” If that’s true, corporate America better watch out.

As publicly traded companies report quarterly sales and earnings, they often review critical economic conditions. Last quarter, nearly 50% of the S&P 500 companies mentioned the term “recession” during their Q2 conference calls with shareholders, according to FactSet. This breaks the previous record set in Q1 2020, at the start of the pandemic.

Unsurprisingly, America’s corporate leaders are preparing for potential economic turbulence. After all, we often see volatility in the financial markets when economic reports raise questions about recession and the Fed’s policies. Words are powerful.

This time next year, the buzzword of the quarter could be something else entirely. Here’s hoping for something like “recovery,” “rebound” or “growth.”

The S&P 500 Composite Index is an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

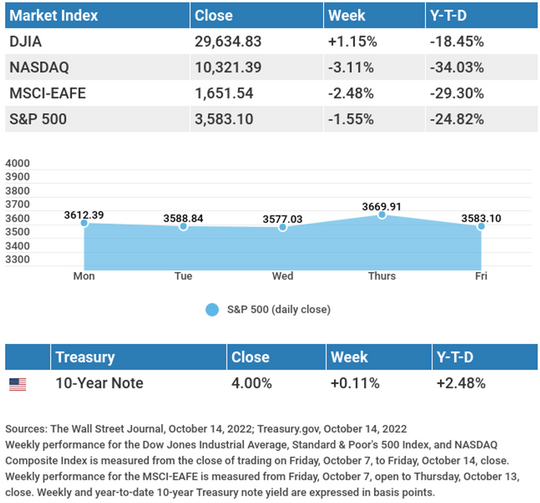

Market Insights

Food for Thought

“You must do the thing you think you cannot do.”

– Eleanor Roosevelt