Streamline the Month End Close Process

Build a Strong Financial Foundation for Your Business

As a business owner, does the month end close often feel like an uphill battle through a sea of administrative tasks? You’re certainly not alone. Closing out monthly finances is crucial, but it can be a daunting task that feels overwhelming.

Yet, it’s worth noting this process doesn’t have to be intricate or intimidating. Indeed, the journey becomes considerably smoother with the support of a well-structured month end closing process and disciplined bookkeeping routines. Furthermore, maintaining a consistent pulse on your financial data is key to steering your business toward its long-term objectives.

What is the month end close process?

The month end close process is an accounting procedure that confirms all information has been entered, reconciled and reviewed for accuracy. The financial team aims to ensure all financial statements are up-to-date, and there are no outstanding invoices, purchase orders, journal entries or other documents that have not been addressed within the appropriate timeframe.

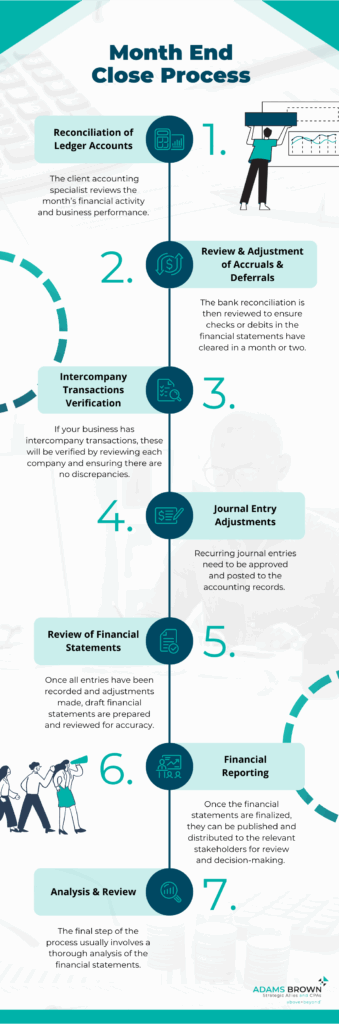

Here are the typical steps involved in a month end close process:

- Reconciliation of Ledger Accounts: The client accounting specialist reviews the month’s financial activity and business performance. This person checks each account in the balance sheet. This is done by obtaining the subsidiary ledgers showing the balance of each account. Once the ledger is verified as accurate, then this balance is reviewed in the actual balance sheet to ensure the number matches the subsidiary ledger.

- Review & Adjustment of Accruals & Deferrals: The bank reconciliation is then reviewed to ensure checks or debits in the financial statements have cleared in a month or two. The reconciliation should not have deposits or credits that are not cleared in the next month. If this activity is still not cleared on the reconciliation, then the accounting specialist will review why this is occurring.

- Intercompany Transactions Verification: If your business has intercompany transactions, these will be verified by reviewing each company and ensuring there are no discrepancies. This is perhaps the most challenging process at month end.

- Journal Entry Adjustments: Recurring journal entries need to be approved and posted to the accounting records. Examples of these entries are current monthly depreciation, reconciling sales tax and payroll liabilities.

- Review of Financial Statements: Once all entries have been recorded and adjustments made, draft financial statements (income statement, balance sheet and cash flow statement) are prepared and reviewed for accuracy.

- Financial Reporting: Once the financial statements are finalized, they can be published and distributed to the relevant stakeholders (like management, investors or lenders) for review and decision-making.

- Analysis and Review: The final step of the process usually involves a thorough analysis of the financial statements to glean insights about the business’s financial performance and health, which aids in planning for the future.

The month end close process might vary slightly from business to business based on size, industry and specific operational needs. Implementing a structured routine and utilizing accounting software can aid in streamlining this process.

Most businesses develop a tailored month-end checklist to ensure all necessary activities are completed thoroughly and efficiently. Below are some common steps that may be included in such a checklist.

- Collect Information: Gather all financial data and documentation from the past month. This includes sales invoices, expense receipts, bank statements, payroll data and any other financial-related documents.

- Review Accounts Receivable: Verify all invoices issued in the period, ensure payments received match your records and note down any outstanding amounts. This will give you a clear understanding of what is owed to your business.

- Review Accounts Payable: Check all bills received in the period, verify payments made and record any pending amounts. This will provide an accurate picture of what your business owes to suppliers and creditors. In addition, the length of the payable is reviewed along with the cash flow analysis to ensure funds are being managed.

- Reconcile Bank Accounts: Cross-reference your bank statements with your business’s financial records. This step confirms that all transactions are accurately recorded in your books and that the balance in your books matches the balance in your bank accounts.

- Review & Record Purchased Assets: If the business has purchased any significant assets during the month (equipment, property, etc.), these need to be recorded in the correct asset account and depreciation schedules updated accordingly.

- Journal Entry Adjustments: Record any adjusting entries that your accounting system has not automatically captured during the month. This could include accrued expenses, prepaid expenses and depreciation among others.

- Review Expense Reports: Double-check all business expense reports to ensure they are accurate and have been categorized correctly.

- Prepare Financial Statements: With all data collected and reconciled, it’s time to prepare your financial statements. This typically includes an income statement (profit and loss), balance sheet and cash flow statement.

- Review Financial Statements: Conduct a thorough review of your financial statements, looking for any discrepancies or irregularities. If any are found, investigate and make the necessary corrections.

- Print & Distribute Financial Statements: After completing the review process and ensuring the accuracy of the financial statements, it is recommended to print them out and distribute them to stakeholders. The business owner should review each monthly financial statement, paying attention to details such as revenue, cost of goods sold (if applicable) and overall operating expenses. This information is valuable for ensuring the product price is set correctly to maximize the owner‘s profit percentage.

Although this checklist is comprehensive, it may need to be customized to suit your business’s unique needs and circumstances. Once the checklist has been developed and each person involved in the process has been identified, the month-end process should be smooth sailing. However, it’s important not to rush through the process, as accuracy is the ultimate goal, and speed does not always ensure accuracy. To avoid this, managing your time and planning the monthly close process on your calendar is helpful. Additionally, cultivating good relationships with all parties involved can help ensure timely information. Finally, take advantage of automation and technology to streamline the process and learn from your mistakes and successes.

The month end close process isn’t just about checking off tasks. It’s a holistic view of your company‘s financial state and an opportunity to deepen your understanding of your business’s financial performance. The insights it provides will serve as a powerful tool as you steer your business toward its long-term goals. Therefore, investing time and effort in optimizing this process is truly worthwhile.

If the burden of managing your books and navigating the month end close process feels overwhelming, consider delegating these responsibilities to the experienced team at Adams Brown. Solutions can be customized to meet your specific needs, big or small. To learn more, contact an Adams Brown advisor.