Kansas Sales Tax Updates

New Sales and Use Tax Rates, Remote Seller Guidance, and a Possible Repeal of the Food Tax

Earlier this year, Kansas introduced several changes to state tax laws, including sales tax updates, economic nexus, and business taxes. The standard deduction for individuals and families increased, too. In terms of sales tax and use updates, this year is far from over. There are new rate changes that began last month for sellers to be aware of.

State of the Union: Kansas Revenue

As of October 2021, Kansas revenue outpaced estimates by 18.7 percent. Kansas recently repaid a $300 million government loan two years early. Additionally, the state’s revised revenue projections indicate a potential $2.8 billion surplus.

In 2022, it’s forecasted that state tax collections will increase by 3.2 percent. These estimates point to a state that has been able to recover well from COVID-19 despite inflation, supply chain disruptions, and other lingering issues.

State Sales Tax Updates

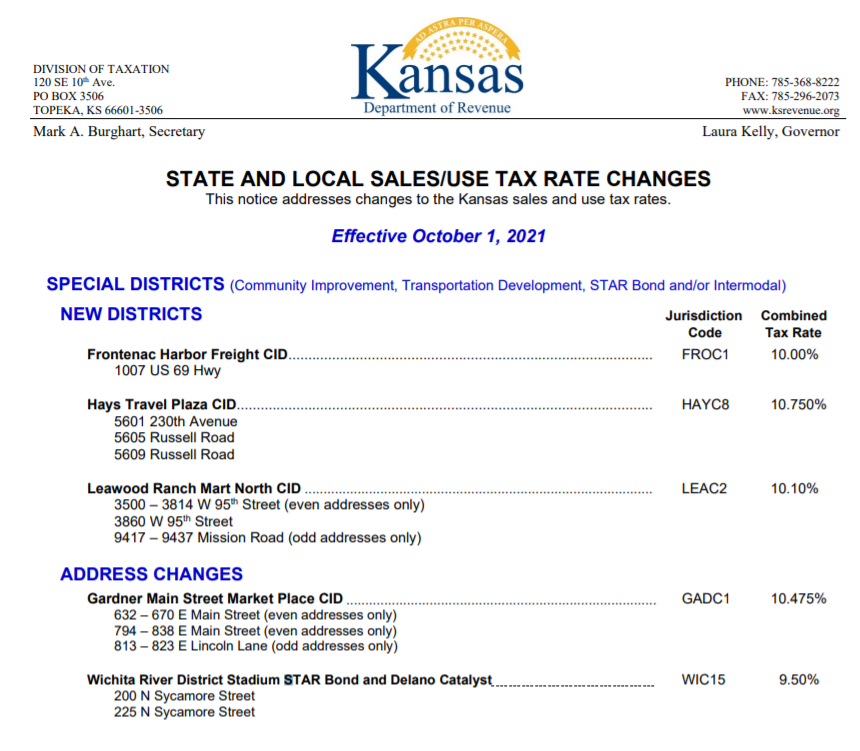

Effective October 1, 2021, the following rate changes took effect.

Kansas has already released its January 2022 sales and use tax rate changes, which include rate changes for Finney, Ford, Gray, and Hodgeman Counties as well as three new districts, two address changes, and two new codes and tax rates.

The “Food Tax”

In November, Governor Kelly introduced a plan to eliminate Kansas’s 6.5 percent tax on groceries, or the “food tax.” Kansas is one of seven states in the nation that fully taxes groceries and the 6.5% tax rate is the second-highest tax rate on groceries in the country. The proposal has garnered bipartisan support; however, it’s expected that Kansas legislature will need to compensate for the $450 million loss in revenue in other areas – namely, taxes for corporations and high-income Kansas residents.

Remote Seller Guidance in Notice 21-17

The Kansas Department of Revenue also issued guidance on November 1, 2021 for remote sellers. Kansas’s new economic nexus rules went into effect on July 1, 2021, and questions remained regarding the definition of a remote seller and the de minimis threshold of $100,000.

‘Remote seller’ now means any retailer that:

- Does business in the state, whether permanent or temporary, direct or indirect, or through a subsidiary

- Uses an employee, independent contractor, agent, representative, salesperson, or other person operating in the state whose purpose is to sell, deliver, install, or otherwise take orders for tangible personal property

- Has a sales tax registration certificate

- Derives rental receipts from leasing tangible personal property situated in Kansas

- Maintains an inventory of tangible personal property within Kansas to sell

- Has contact with Kansas that would require collecting and remitting sales tax.

Even if a retailer doesn’t meet the definitions above, if it has at least $100,000 in gross receipts to Kansas customers between January 1 and June 30, 2021, it still satisfies the requirements of a remote seller for purposes of economic nexus.

This notice further stated that Kansas remote sellers must collect and remit the marketplace sales tax on all sales after $100,000 is reached. All sales count towards this threshold, even when the item is not taxable.

Kansans should be using this time before the end of the year to estimate their taxes going forward and create a plan. 2022 will see many changes across the board, not to mention quarterly sales and use tax rate changes that can change tax collections mid-year. To talk more about tax planning opportunities, contact your Adams Brown advisor.