Great Bend & Ellinwood, Kansas Sales Tax Increases on April 1, 2022

Important Information for Barton County Business Owners & Residents to Know

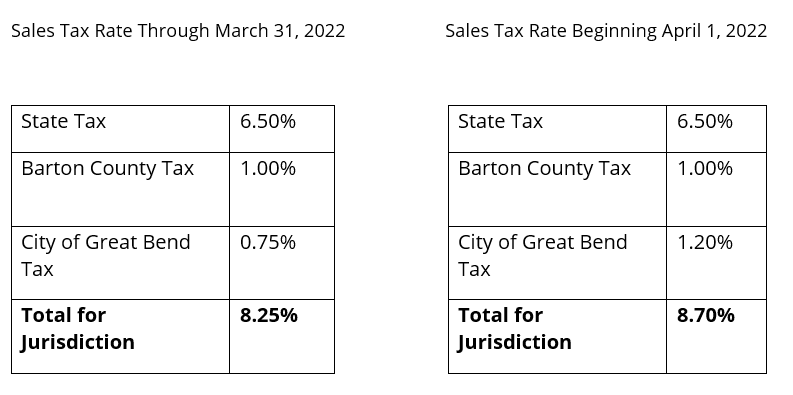

Voters in Great Bend, Kansas approved a 0.45% retail sales tax increase during the November 2021 General Election. The new sales tax rate of 8.70%, up from 8.25%, takes effect on April 1, 2022. Revenue generated from the sales tax increase is earmarked for quality of life improvements, a new police station, and a public safety pension plan. Great Bend’s last sales tax rate increase occurred in July 2018 when an increase of 0.25% was imposed for street repairs and maintenance

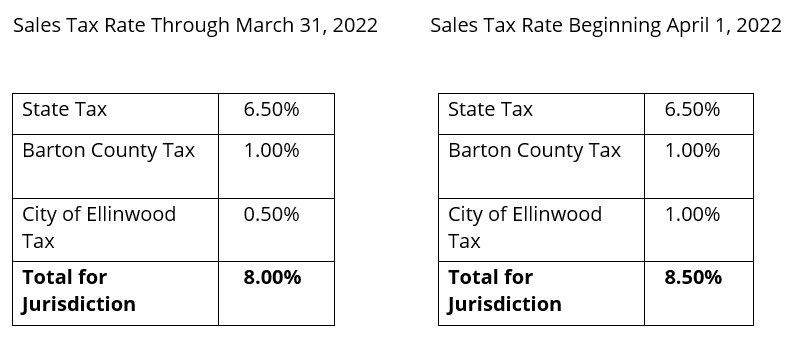

Voters in Ellinwood, Kansas also approved a retail sales tax increase of 0.50% during the most recent election. The new sales tax rate of 8.50%, up from 8.0%, takes effect on April 1, 2022. The increase in sales tax revenue is intended for construction, maintenance and repair of general infrastructure and other governmental needs. Ellinwood’s last sales tax rate increase occurred in July 2015.

Information for Business Owners

Beginning April 1, 2022, retailers making or delivering sales within these two jurisdictions must increase the sales tax rates applied to sales orders. You are responsible for remitting the appropriate sales tax to the Kansas Department of Revenue regardless of what is collected from customers. Remember to update the rates applied to invoices and sales in your point-of-sale (POS) and accounting system

Make sure to contact your Adams Brown advisor if you have questions or need more information.

Make sure to contact your Adams Brown advisor if you have questions or need more information.