Fickle Fed Focused on Jobs

It seems like just yesterday the Fed was all about inflation. So why are Jerome Powell & Crew now talking about jobs?

A look inside ADP’s November report shows why they are looking past inflation (for the moment) and focusing on the “sluggish” job market.

As you can see below, job creation at small firms has come to a halt. Firms with fewer than 50 employees lost 120,000 jobs during the first two weeks of November. Mid-sized and large companies picked up some of the slack.

As of Dec. 16, 2025, the Bureau of Labor Statistics reported 64,000 jobs added in November, with healthcare gaining 46,000 and construction 28,000. Manufacturing had a loss of 5,000 jobs in November, after a loss of 9,000 jobs in October.

There is always something to worry about when investing. In fact, there’s even a saying about it. “Wall Street climbs a wall of worry.” Some people believe, “I’ll wait until it all gets resolved.” But remember, those were the same people who in the Spring suggested, “I’m going to the sidelines until the tariff issue gets resolved.” Since May, stock prices have advanced for six consecutive months, despite unresolved tariff issues.

Market Insights

Stocks ended last week mixed. A widely anticipated Federal Reserve decision on interest rates and a rotation into non-tech areas helped push the Dow Industrials higher, while the broader market and technology stocks lagged behind.

The Standard & Poor’s 500 Index declined 0.63 percent, while the Nasdaq Composite Index fell 1.62 percent. Meanwhile, the Dow Jones Industrial Average advanced 1.05 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, rose 0.89 percent.

Market Rotation After Fed Decision

Stocks stayed in a fairly tight trading range over the first half of the week. Tech remained a strong spot on Monday despite slight to modest declines in all three major averages.

By Tuesday’s close, all three major averages were slightly to modestly lower week-to-date as the Fed’s last interest-rate-setting meeting of the year approached.

Then, on Wednesday morning, stocks rose ahead of the Fed’s announcement that it was lowering rates by a quarter percentage point—a widely expected move. By the close, all three major averages ended in the green.

A market rotation theme dominated the rest of the week, as investors shifted into cyclical areas of the economy that are likely to benefit from an economic rebound. The Nasdaq ended Thursday’s session lower, while the S&P and Dow Industrials hit fresh record closes. The Russell 2000 Index of small-cap stocks also notched new closing highs.

The rotation into value stocks continued on Friday, with some AI names coming under pressure. The financial, healthcare, and industrial sectors were among the groups that seemed to benefit from the rotation.

No Surprise, Just Tea Leaves

Last week’s rate decision from the Federal Reserve was no big surprise. Speculators had already priced in this outcome weeks ago.

Now for reading the tea leaves: First, Fed Chair Powell stated in his press conference on Wednesday that they have ruled out a rate hike for the foreseeable future, but also noted that it would be a higher bar for further rate reductions. Another point was the degree of dissent: the vote was 9-3.

Then on Friday, voting members who dissented expressed views on inflation and jobs, and which risk was the more important one to address through monetary policy.

2026 Federal Tax Update

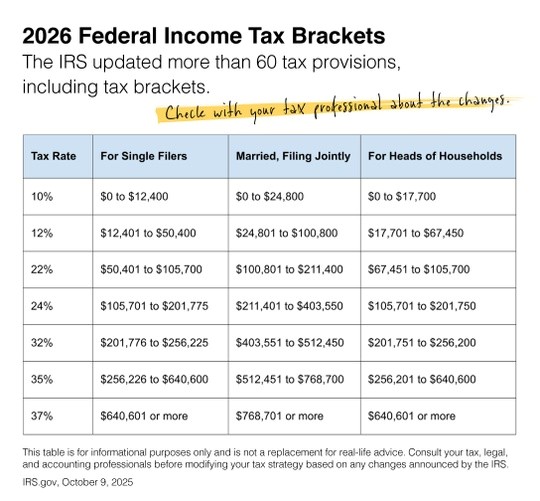

When the One Big Beautiful Bill (OBBB) Act was passed on July 4, the legislation left several unanswered questions that the IRS is now addressing. The IRS undergoes this process every year, but this time around, the OBBB has added to the uncertainty. The Internal Revenue Service reviews more than 60 tax provisions for inflation to prevent what is known as “bracket creep.”

The IRS announced new federal income tax brackets and standard deductions for 2026 in early October. The agency adjusted several numbers, which apply to tax year 2026 for returns filed in 2027.

Other Highlights

The standard deduction will also increase in 2026, rising to $32,200 for married couples filing jointly, up from $31,500 in 2025. Starting in 2026, single filers can claim $16,100, a bump up from $15,750.

The AMT exemption amount for 2026 is $90,100 for singles and $140,200 for married couples filing jointly.

The IRS also provided updates for the Earned Income Tax Credit, the Child Tax Credit, capital gains tax rates and brackets and qualified business income deductions.

Contact us if you have any questions about the IRS updates or any other tax law changes.

Source(s):

CNBC.com, December 3, 2025. “November private payrolls unexpectedly fell by 32,000, led by steep small business job cuts, ADP reports.”

Source: YCharts.com, December 13, 2025. Weekly performance is measured from Monday, December 8, to Friday, December 12. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

WSJ.com, December 10, 2025