Feds Managing SVB & Inflation

Monthly Economic Update

For the Federal Reserve, credibility is everything. And its credibility is being tested by how it plans to manage the banking system in the days leading up to its March 21-22 meeting. Last month, Fed Chair Powell confidently told Wall Street to prepare for a 25-basis point increase in short-term rates in March. But with inflation remaining hot, some speculators have been calling for a 50-basis point bump.

To complicate matters further, 2022’s rapid rise in interest rates appears to be a stressor on the banking system. The Federal Deposit Insurance Corporation (FDIC), in recent days, took control of both Silicon Valley Bank (SVB) and Signature Bank (SB). And now some are suggesting that the Fed should pause its strategy to manage inflation with higher interest rates to help the banking system.

In short, the Fed is at a bit of a credibility crossroads. Supervising and regulating the banking system as a means of protecting consumers is one of the Fed’s most important roles. That’s why the U.S. government has already approved plans to safeguard depositors and financial institutions affected by the closing of both SVB and SB.

At the same time, Wall Street wants to believe the Fed is data-dependent, not data-reactive. The markets want to believe the Fed has a plan for inflation and is considering how higher short-term interest rates are affecting the nation’s banks.

So it’s best to prepare for more market volatility in the days leading up to the Fed’s two-day meeting. Wall Street is sorting through several issues, and it’s looking to the Fed to provide some reassuring guidance.

Market Insight

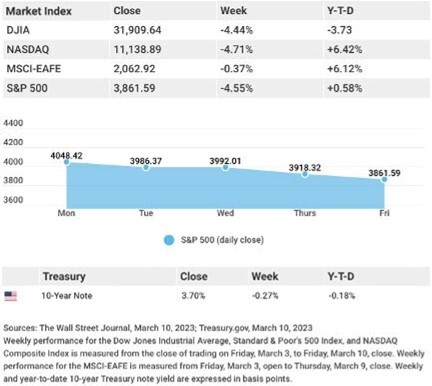

Stocks tumbled last week as investors reconsidered their interest rate expectations after Fed Chair Powell’s Congressional testimony that rates may need to go higher. Stocks also were rattled when awest coast bank was placed into receivership on Friday following a run on deposits.

The Dow Jones Industrial Average dropped 4.44%, while the Standard & Poor’s 500 lost 4.55%. The Nasdaq Composite index fell 4.71% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.37%.

Rate Fears, Bank Scare

Congressional testimony by Fed Chair Jerome Powell that interest rates may require a higher increase faster than planned unnerved investors, dimming the hopes of any pause in rate hikes this summer. After stabilizing the following day, stocks trended lower as the financial sector came under pressure. The lower move was triggered by a specialty bank’s liquidity issues, though regional and money center banks could not escape the selling.

Labor market strength in a Friday report exacerbated rate-hike anxieties, though cooling wage gains balanced an above-consensus new jobs number. Markets appeared to take the employment report in stride but fell on worries arising from the shutdown of a tech-centric bank.

Powell’s Congressional Testimony

Fed Chair Powell testified on Capitol Hill during which he acknowledged that the economy was running hotter than he had expected. He said that labor market strength and stubbornly elevated inflation may require the Fed to raise rates quicker than anticipated and above levels previously contemplated.

The market did not respond well to Powell’s change of tone. Many now see the potential of a 0.50% rate hike coming out of the Federal Open Market Committee’s (FOMC) March 21-22 meeting instead of the expected increase of 0.25%. Powell did say that the FOMC would consider the monthly employment report released last Friday and upcoming inflation reports before arriving at a decision.

Source: The Wall Street Journal, March 10, 2023