Extended Time to Report Provider Relief Fund Payments

Reporting Requirements Have Been Revised

In June, the Department of Health and Human Services (HHS) revised the Provider Relief Fund (PRF) Post-Payment Notice of Reporting Requirements that were initially issued January 15, 2021. Key updates include:

- Instead of requiring all payments be used by June 30, 2021, the period of availability of funds is based on the date that the payment is received.

- Rather than reporting $10,000 cumulatively across all PRF payments, recipients are required to report for each Payment Received Period in which they received one or more payments exceeding $10,000.

- These reporting requirements now apply to the recipients of the Skilled Nursing Facility and Nursing Home Infection Control Distribution in addition to General and Targeted Distributions.

- The PRF Reporting Portal will open for providers to submit information July 1, 2021.

What do I need to register?

Before beginning the registration process, you should have the following on hand:

- Tax ID Number (TIN)

- Business name of the reporting entity

- Contact information for the individual submitting the report

- Address of the Reporting Entity

- TINs of subsidiaries in a list detailed by commas

- Payment information for any payments received

- TIN of Entity

- Payment amount

- Mode of payment – check or direct deposit ACH

- Check number or ACH settlement date

The expenses listed below are eligible expenses covered by PRF payments, but they are unreimbursed by other sources such as PPP loans, Employer Retention Tax Credits &/or local grants. Correctly allocating all expenses to the appropriate bucket and maintaining the appropriate documentation is important so that repayment of the funds is not required.

Expenses Eligible for Reimbursement

General and Administrative Expenses

- Mortgage/Rent

- Insurance

- Personnel hired specifically to help the ease of COVID

- Fringe Benefits

- Lease Payments

- Utilities/Operations

- Liability Insurance

- Other G & A Expenses

Nursing Home Infection Control Distribution Payments have their own reporting requirements such as Health Care-Related Expenses:

- Supplies

- Equipment

- Information Technology

- Facilities

- Other Health Care-Related Expenses

Reporting Registration

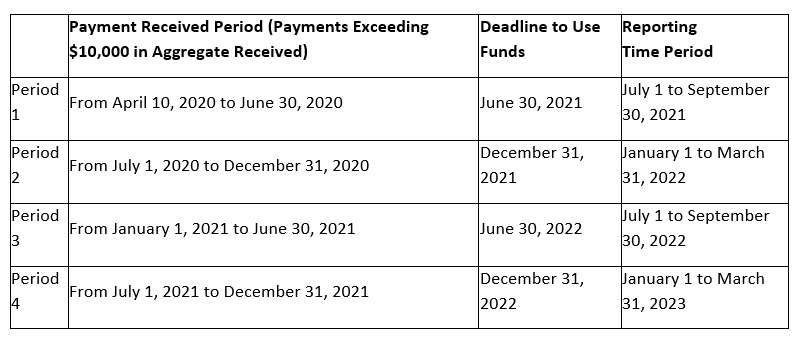

If you received one or more payments exceeding $10,000 during a Payment Received Period, you are required to report in each applicable Reporting Time Period as outlined in the table below. You are encouraged to register in the portal in advance of the Reporting Time Period dates that are applicable to you. The registration process will take approximately 20 minutes to complete and must be competed in one session.

Our healthcare service line team members are equipped & ready to help you be proactive with tracking the use of these funds now even if your reporting cycles are later. If you need help with these reporting requirements, contact your Adams Brown advisor today.