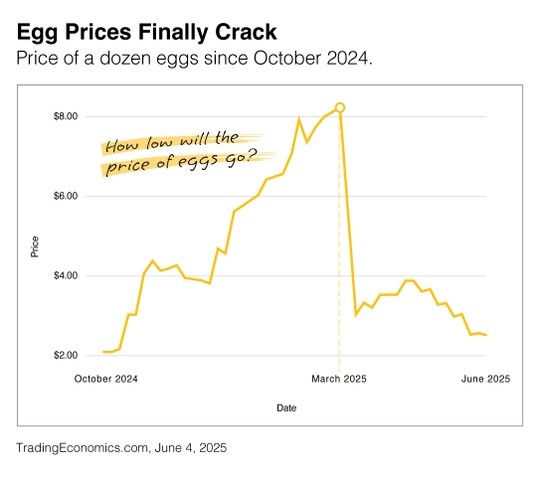

Egg-onomics: A Lesson in Price Moves

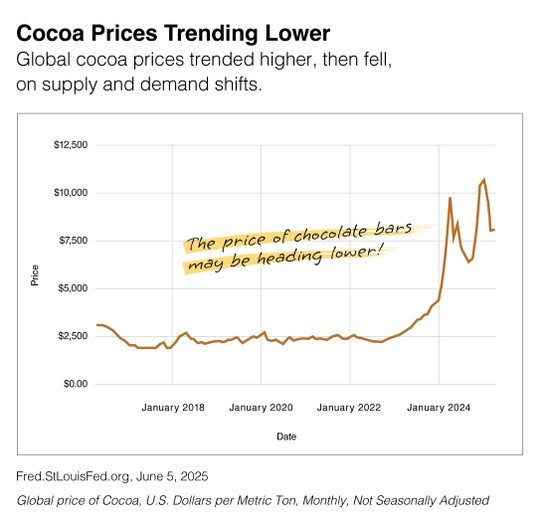

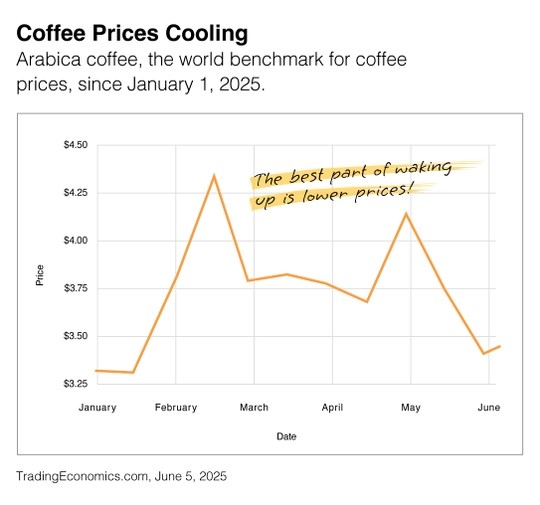

Isaac Newton might be smiling if he looked at the charts for eggs, cocoa and coffee prices

To traders, they are a lesson on how markets can reach an extreme and then correct. But to Newton, they are simply a lesson in gravity.

Egg-onomics: The price of a dozen eggs hit $8.12 in March. It’s $2.53 in June. Why the drop? Demand has slowed, and supply has increased.

Candy-palooza: Chocolate (cocoa) hit $10,417 per kilogram in December. It’s now $8,163. Why the drop? Less demand from North America, combined with favorable weather patterns.

Coffee-bucks: A pound of coffee touched $4.34 in February. It’s $3.45 in June. Why the drop? Production has increased, and the weather has been favorable in growing areas.

Once you read about big price swings like what happened in eggs, coffee and cocoa, it’s likely that most of the upside—or downside—move has already been completed. And chasing trends rarely works when investing for the long term.

What does work is focusing on your goals and time horizon and selecting investments that match your risk tolerance. For most, building wealth is a process that’s helped by consistent investing and time.

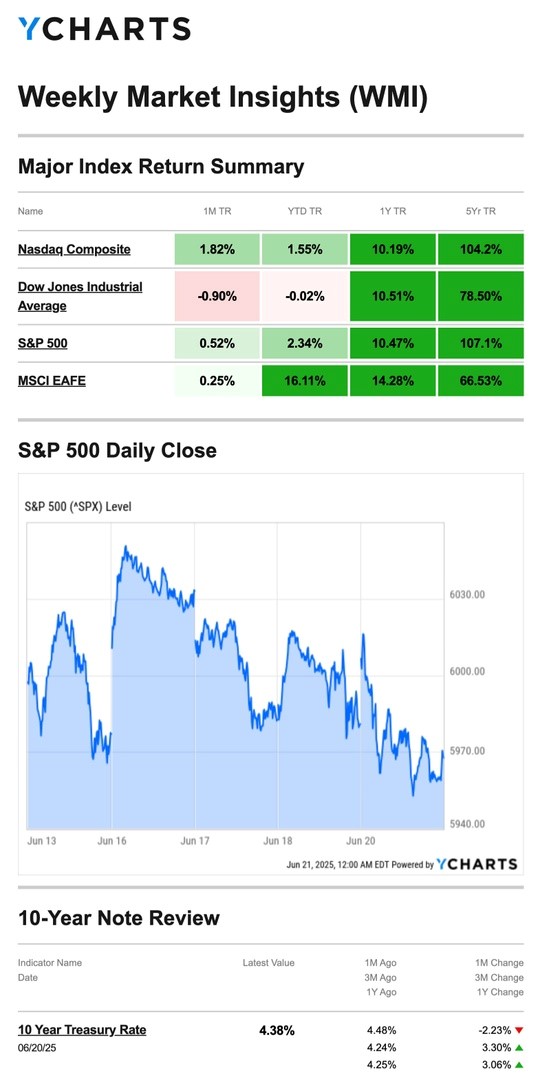

Market Insights

Stocks were mixed during the holiday-shortened trading week as uncertainty over conflict in the Middle East weighed on investors.

The Standard & Poor’s 500 Index slipped by 0.15 percent, while the Nasdaq Composite Index rose by 0.21 percent. The Dow Jones Industrial Average was flat (+0.02 percent). The MSCI EAFE Index, which tracks developed overseas stock markets, declined 1.54 percent.

U.S. Stocks Slide

Stocks opened higher, and oil prices fell at the start of the week as investors hoped Middle Eastern tensions would ease.

However, as investors parsed through updates on the conflict, stocks fell over ongoing uncertainty. Conflicting statements from those involved, as well as from world leaders, contributed to the uncertainty.

Midweek, stocks rallied ahead of the Fed’s interest rate decision. Markets seemed to dismiss news that housing starts dropped unexpectedly to their lowest level in five years.

The Fed held short-term rates steady. Stocks moved up and down during the Fed Chair’s press conference before ending the trading session slightly down ahead of Thursday’s stock market holiday.

Following the holiday, anxious investors refocused on geopolitical tensions and developments. As the week closed out, investors appeared to take a risk-off approach heading into the weekend.

Source: YCharts.com, June 21, 2025. Weekly performance is measured from Friday, June 13 to Friday, June 20.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

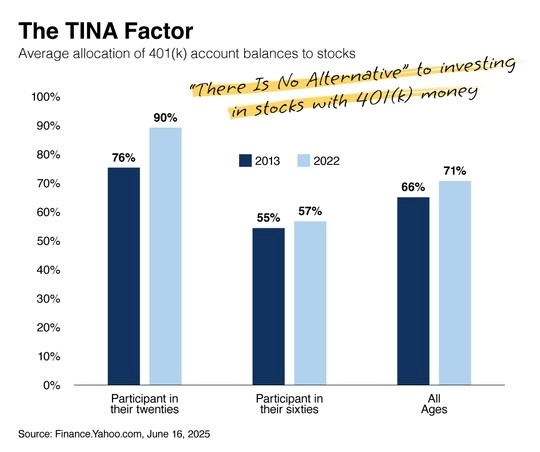

Is TINA Managing Your Money?

Who the heck is TINA?

TINA is an acronym that stands for “There Is No Alternative” to stocks. And for most retirement-minded investors, TINA is their money manager.

As you can see, 71% of 401(k) account balances were allocated to stocks in 2022. People in their 60s had slightly less allocated to stocks, while participants in their 20s were almost exclusively in equities.

It’s difficult to argue against the strategy, especially for someone in their 20s. Since 1957, the Standard & Poor’s 500 index has delivered an annual return of more than 10%. But patience, focus and commitment are required. The path since 1957 has been anything but smooth, with recessions, global crises and geopolitical events.

For people who are approaching retirement, should TINA be managing their money?

It’s possible, but there are many other factors to consider when a person stops accumulating assets and starts spending assets they have spent a lifetime accumulating. Not to mention how Social Security factors into the equation.

Source: Finance.Yahoo.com, June 16, 2025, “The Stock Market’s Secret Weapon: Insatiable Demand from American Retirement Accounts”