Bull Market Leaving Some Behind

Rally Stalls

The stock market drifted lower last week as the tug-of-war between bulls and bears played out in a week that was light on market-moving news.

After falling in the first days of a holiday-shortened trading week, stocks rebounded on Thursday to recover some of the week’s losses. Stocks looked past Congressional testimony by Fed Chair Powell, who said two more rate hikes are likely in the wake of interest rate hikes by central bankers in the U.K., Switzerland, Norway, and Turkey.

The retreat continued into Friday, fueled by global growth fears from new economic data indicating more robust economic slowdowns in the eurozone, Japan, and Australia.

Market Insights

Stocks took a breather last week as investors digested the previous week’s surge and the month-to-date solid gains.

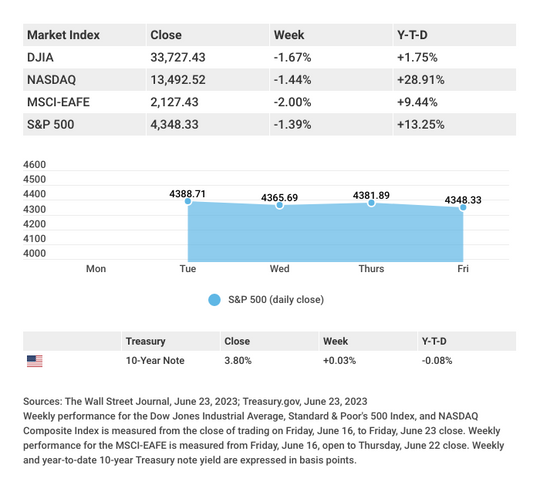

The Dow Jones Industrial Average lost 1.67%, while the Standard & Poor’s 500fell 1.39%. The Nasdaq Composite index dropped 1.44% for the week. The MSCIEAFE index, which tracks developed overseas stock markets, tumbled 2.00%.

Fed Hits Pause Button On Rate Hikes

Jerome Powell skipped an interest rate hike at the Fed’s June meeting, but the market isn’t buying what the Fed Chair is selling about what’s next with short term rates.

Powell signaled that two more rate increases may still be in store for later this year and indicated that “we’re talking about a couple of years out” before the Fed might cut rates.

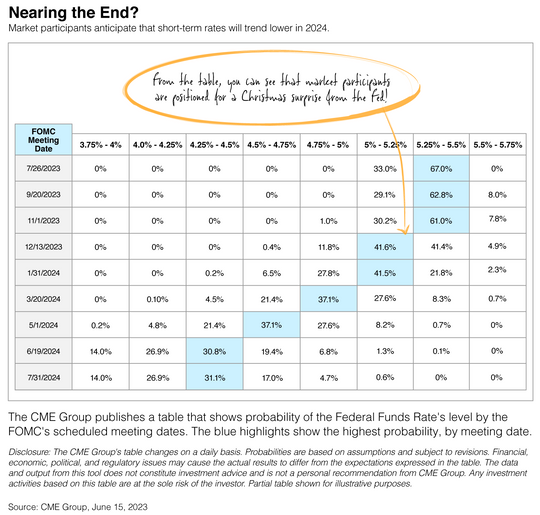

But that’s not what market participants anticipate. As you can see in the accompanying chart, most see one more rate increase later this year, and the consensus sees rates trending lower as early as December 2023.

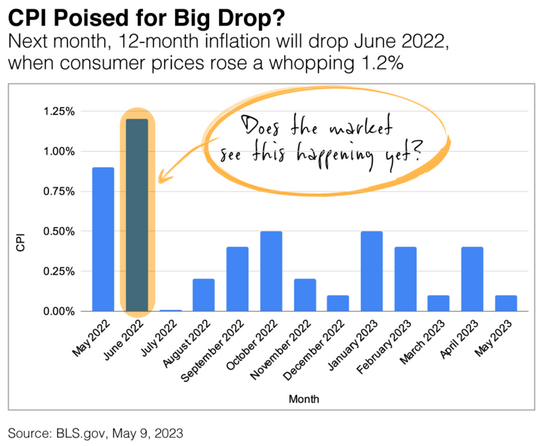

To Powell’s credit, he said the Fed hasn’t yet decided on July’s policy, which means all eyes will closely watch economic reports such as the Consumer Price Index (CPI). As you can see in the other chart, next month the whopping 1.2% increase from June 2022 will be dropped from the 12-month rate.

The Cleveland Fed, which published the widely followed Inflation Nowcasting tool, is forecasting a 3.22% annual rate for CPI in June 2023. That’s getting close to the Fed’s long-term inflation target of 2.0%.

But I can understand why Fed Chair Powell is conservative with his interest rate outlook. He was the same person who tried to convince the markets that “inflation was transitory” in early 2021. He doesn’t want his legacy as Fed Chair to be that he underestimated inflation – twice!

Navigating monetary policy in recent years has been extremely challenging. But I expect the Fed will be happy to report upbeat news in the months ahead if warranted.

Housing Sentiment Improves

Home builders’ confidence edged into positive territory for the first time in 11 months, aided by strong demand, low inventory and a recovering supply chain. May’s new home sales, which rose 21.7%–the most significant percentage gain since October 2016, validated this confidence. The number of new home starts in May (1.63 million) hit a 13-month high, with both single- and multi family homes up substantially.

Sales of existing homes in May rose 0.2% month-over-month while declining 20.4% from a year ago. The existing home market continues to suffer from low inventory and still-high prices. The median price of a home sold in May declined 3.1% year-over-year to $396,100.