Employee Retention Tax Credit

Immediate Tax Savings Opportunity

The Employee Retention Tax Credit (ERTC) is a refundable payroll tax credit for businesses and nonprofits that experienced a shutdown to comply with government COVID-19 orders. The credit also applies to businesses with a 50% reduction in gross receipts when compared to the same quarter in the previous year.

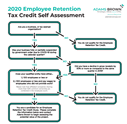

All Kansas employers should immediately assess their situation to determine eligibility and how much savings can be claimed. Review our 2020 Employee Retention Tax Credit Self-Assessment Tool to determine eligibility.

Expanded Saving Opportunities in 2021

The recently enacted COVID-19 relief bill extended the credit through December 31, 2021, and enhanced the value by increasing the per employee savings maximum to $28,000 per four-quarter period. The eligibility criteria were modified to permit those with a 20% reduction in business in a 2021 quarter, when compared against 2019, to participate. Since it is a refundable credit, any amount which exceeds certain payroll tax liabilities will be refunded.

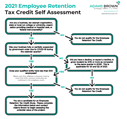

Looking ahead, it is important to be prepared at the end of each quarter to claim the credit. Remember, you do not have to wait until year-end to claim the savings. Review our 2021 Employee Retention Tax Credit Self-Assessment Tool to determine eligibility.

Do you qualify? Start your 2020 Self-Assessment:

Do you qualify? Start your 2021 Self-Assessment: