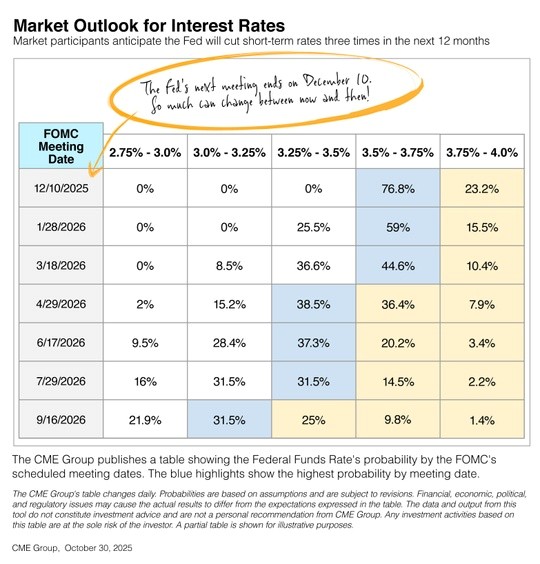

What’s the Outlook for Interest Rates?

The business of making forecasts can be a slippery slope. But some investors are willing to “put their money where their mouth is” when it comes to making predictions about what’s next for short-term interest rates, so it can be helpful to check out what they think is going to happen.

As you can see, speculators anticipate the Fed will lower short-term rates three times in the next 12 months from the current range of between 3.75 percent and 4 percent. And these speculators can place trades if they have a strong enough conviction about the future.

Following the Fed’s October meeting, Fed Chair Powell said he wasn’t certain about whether the Fed would adjust rates again in 2025, which jolted the financial markets. Speculators had assumed there was one more rate change “penciled in” for 2025, so the news caught some by surprise.

“A further reduction in the policy rate at the December meeting is not a foregone conclusion,” Powell said. That’s an important sentence for all investors to keep in mind. The Fed’s job is to constantly monitor the economy as it sets monetary policy. There are no foregone conclusions—only speculators who attempt to anticipate what’s next.

If rates do trend lower, that may affect everything from mortgage rates to credit cards to automobile loans. It may also prompt a review of some fixed-rate investments. But let’s not put the cart in front of the horse. If Fed Chair Powell is not ready to make any conclusion, it’s best for everyone to adopt a wait-and-see approach before making any decisions.

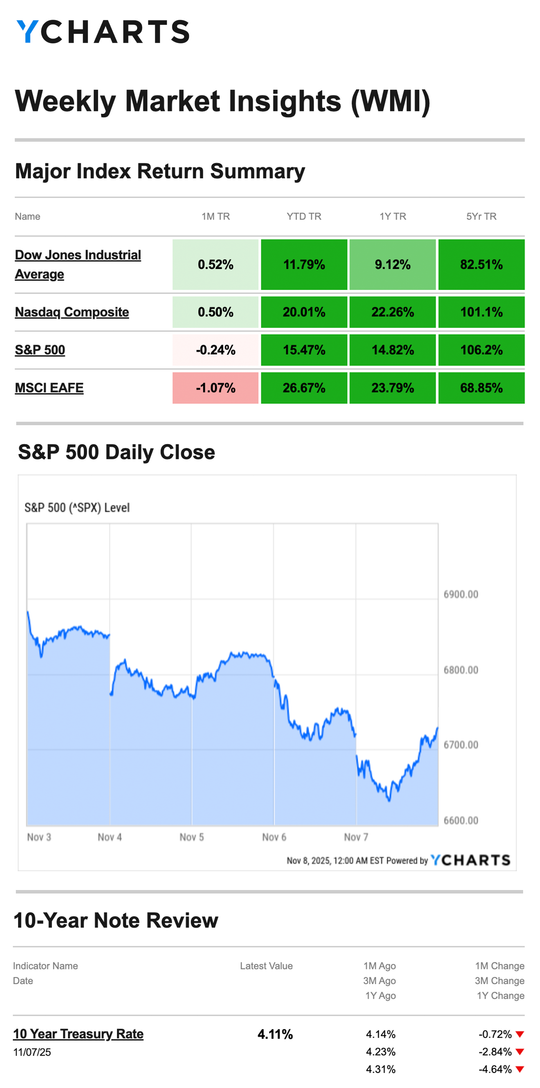

Market Insights

Stocks hit a rough patch last week as fresh labor market data, low consumer sentiment and the government shutdown unnerved investors. The Standard & Poor’s 500 Index declined 1.63 percent, while the Nasdaq Composite Index dropped 3.04 percent. The Dow Jones Industrial Average fell 1.21 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, edged down 0.83 percent.

Nasdaq’s Toughest Week Since April

Stocks started the week mixed. The S&P 500 and Nasdaq each rose modestly, while the Dow Industrials fell. Markets stabilized midweek after an ADP jobs report showed stronger-than-expected hiring by private employers in October. The report buoyed investor sentiment, pushing all three major averages higher.

However, stocks fell as investor concerns over stock valuations persisted, particularly among companies related to AI. Following a well-known outplacement firm’s report of a steep increase in corporate layoffs, selling pressure intensified as investors continued to react to data updates from alternative sources in the absence of official government data.

Stocks slid again on Friday after news that consumer sentiment hit its lowest level in three years. The survey data appeared to exacerbate investor nerves about the reading’s connection to a fragile labor market and the impacts of the government shutdown.

But all three major averages then began a recovery rally midday Friday, with the S&P and Dow Industrials climbing back into the green and the Nasdaq regaining nearly all of its losses by the closing bell.

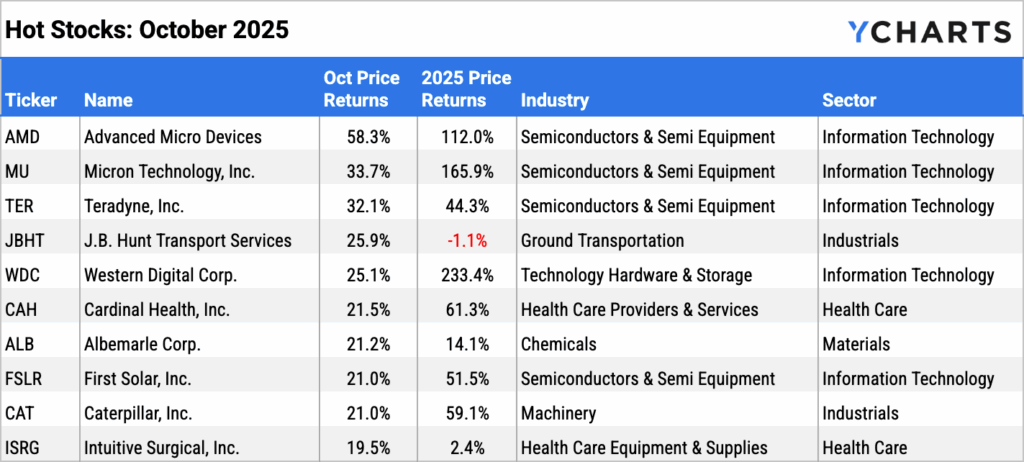

Top 10 S&P 500 Performers of October 2025

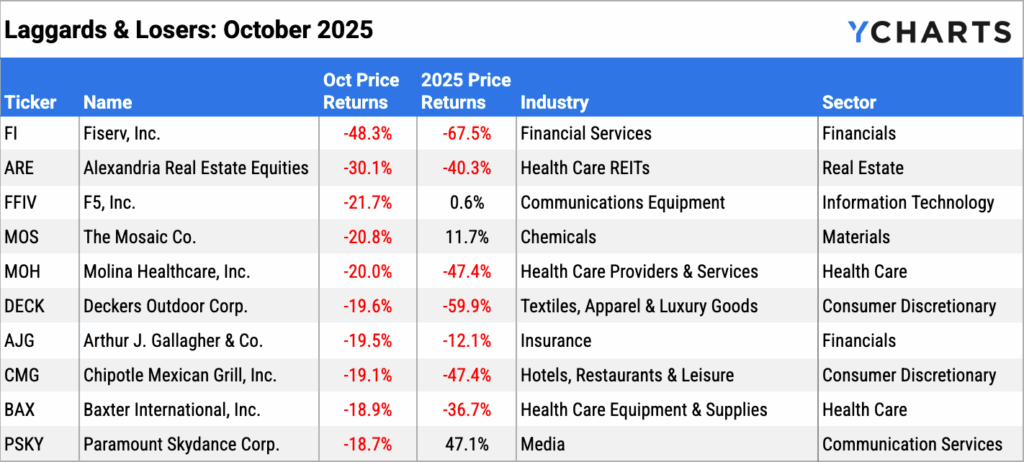

10 Worst S&P 500 Performers of October 2025

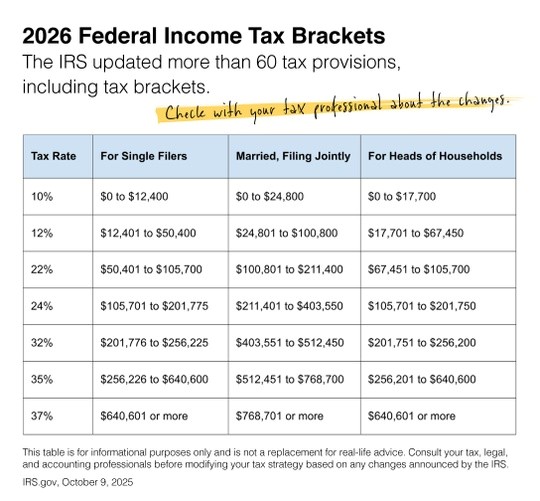

2026 Federal Tax Update

When the One Big Beautiful Bill (OBBB) Act was passed on July 4, the legislation left several unanswered questions that the IRS is now addressing. The IRS undergoes this process every year, but this time around, the OBBB has added to the uncertainty. The Internal Revenue Service reviews more than 60 tax provisions for inflation to prevent what is known as “bracket creep.”

The IRS announced new federal income tax brackets and standard deductions for 2026 in early October. The agency adjusted several numbers, which apply to tax year 2026 for returns filed in 2027.

Other Highlights

The standard deduction will also increase in 2026, rising to $32,200 for married couples filing jointly, up from $31,500 in 2025. Starting in 2026, single filers can claim $16,100, a bump up from $15,750.

The AMT exemption amount for 2026 is $90,100 for singles and $140,200 for married couples filing jointly.

The IRS also provided updates for the Earned Income Tax Credit, the Child Tax Credit, capital gains tax rates and brackets and qualified business income deductions.

Contact us if you have any questions about the IRS updates or any other tax law changes.

Source(s):

CNBC.com, October 29, 2025. “Fed cuts rates again, but Powell raises doubts about easing at next meeting”

YCharts.com, Nov. 8, 2025. Weekly performance is measured from Monday, Nov. 3, to Friday, Nov. 7. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.